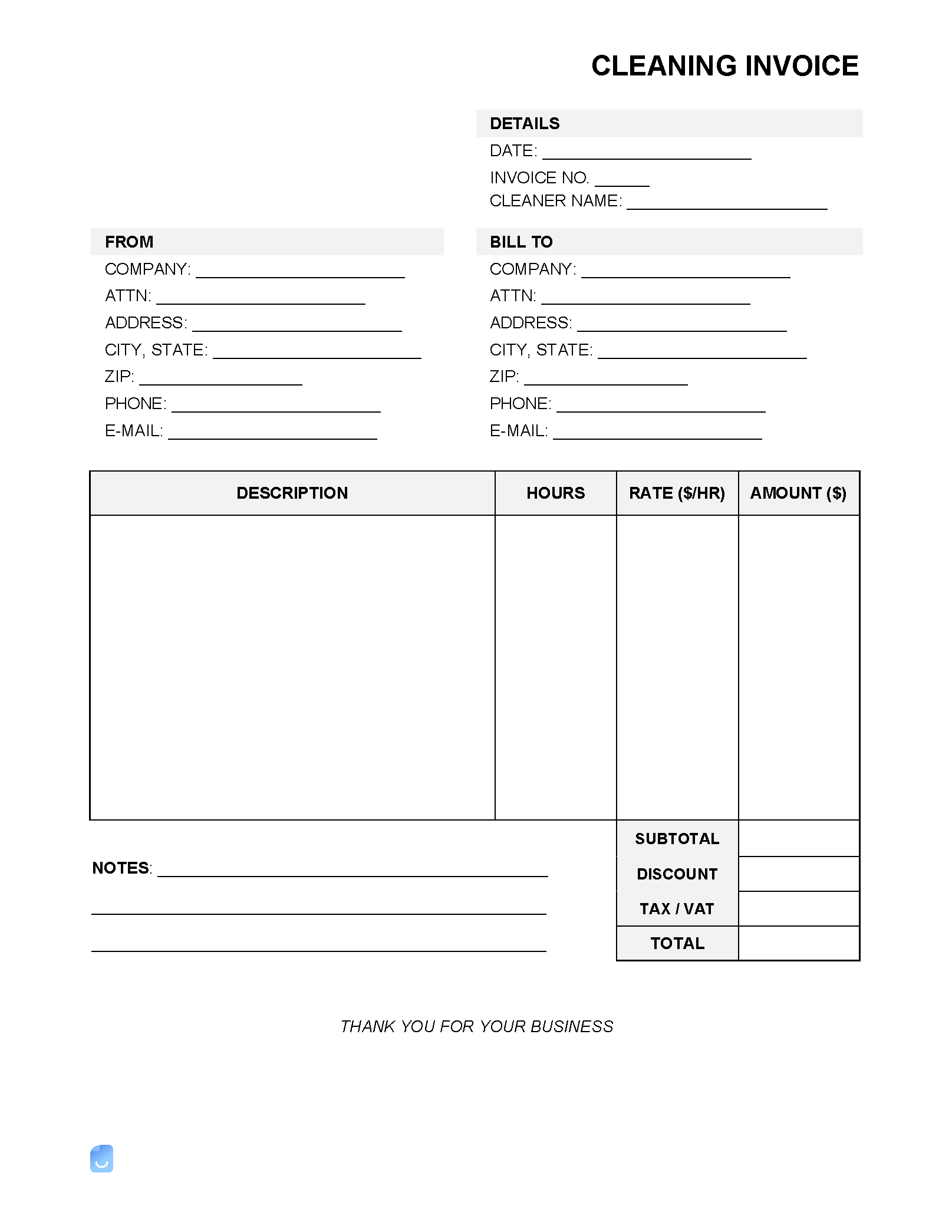

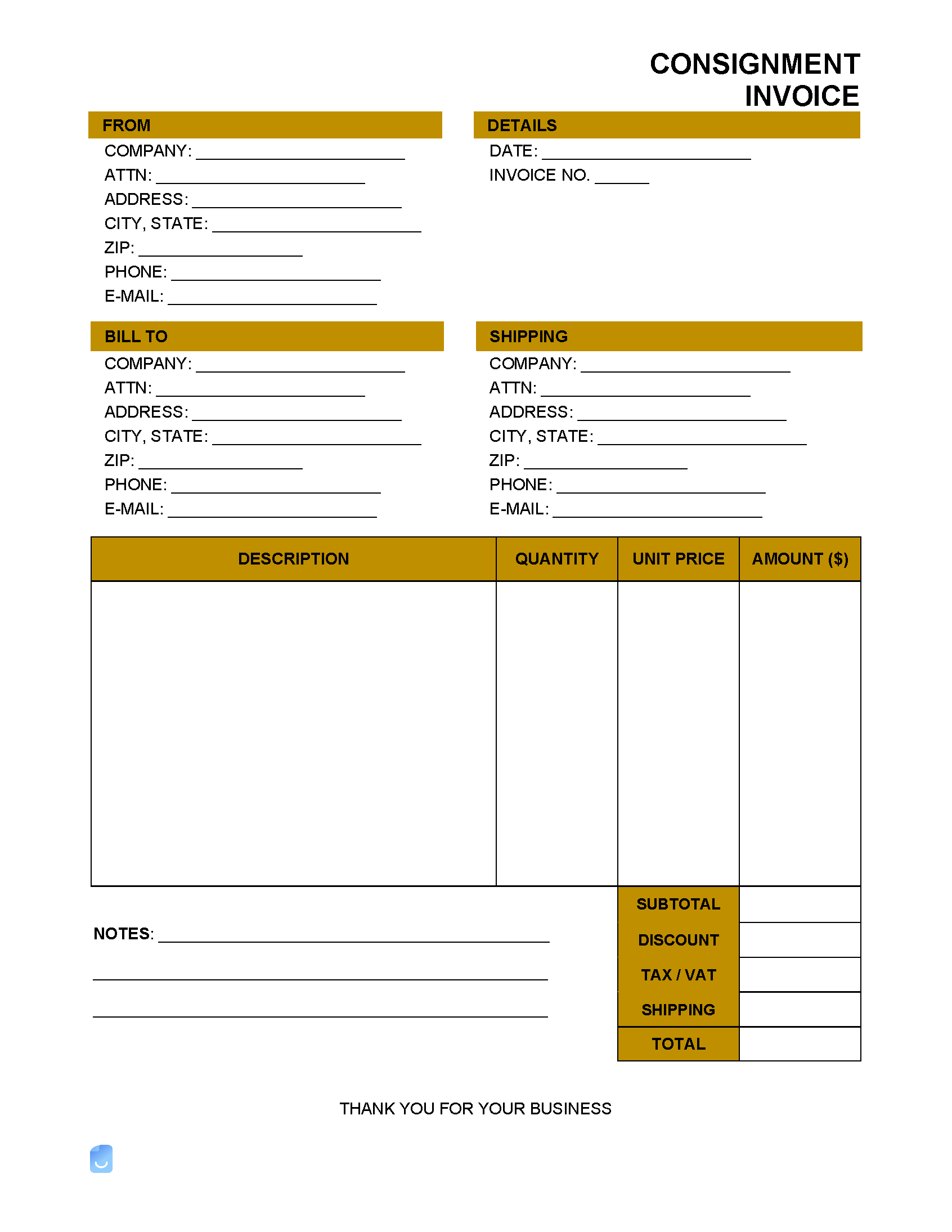

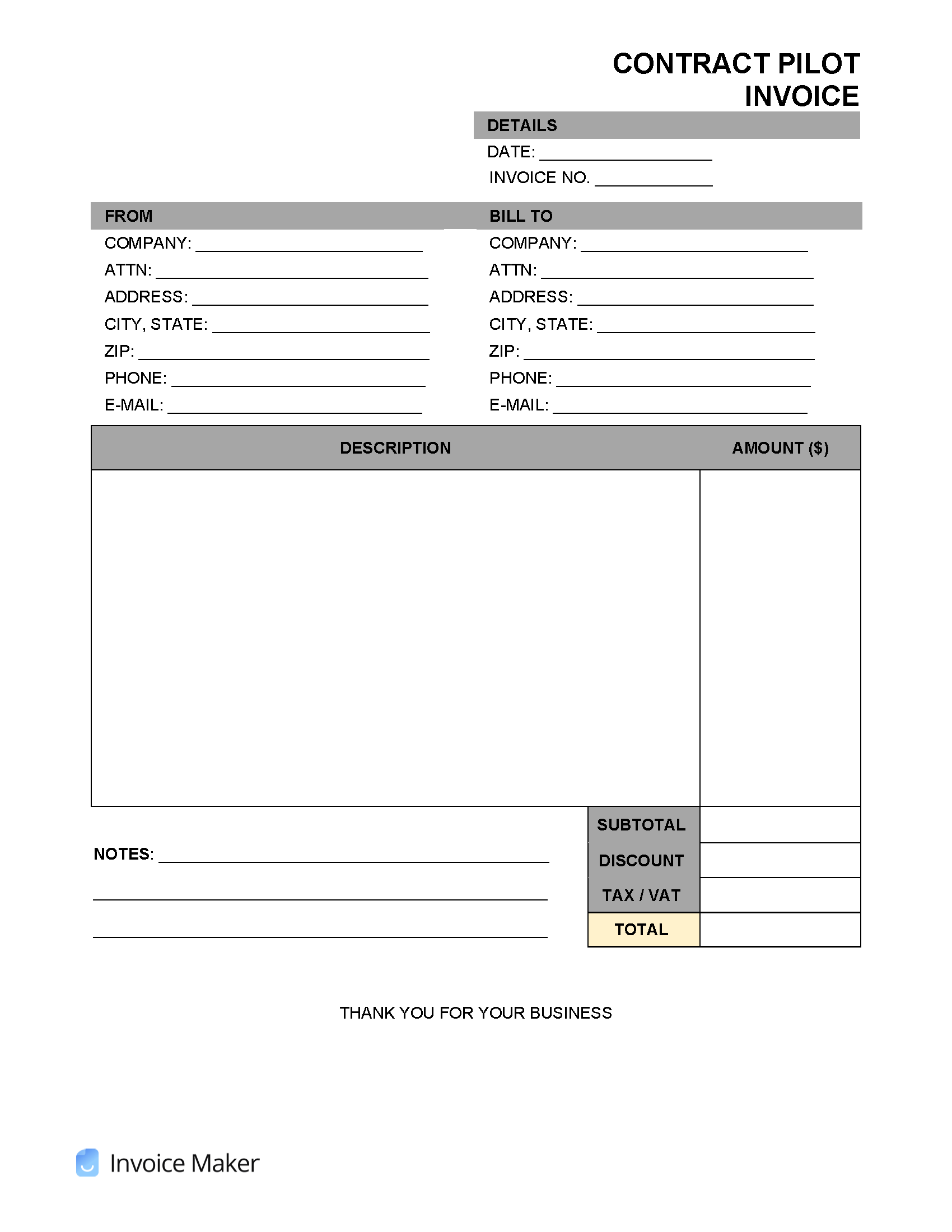

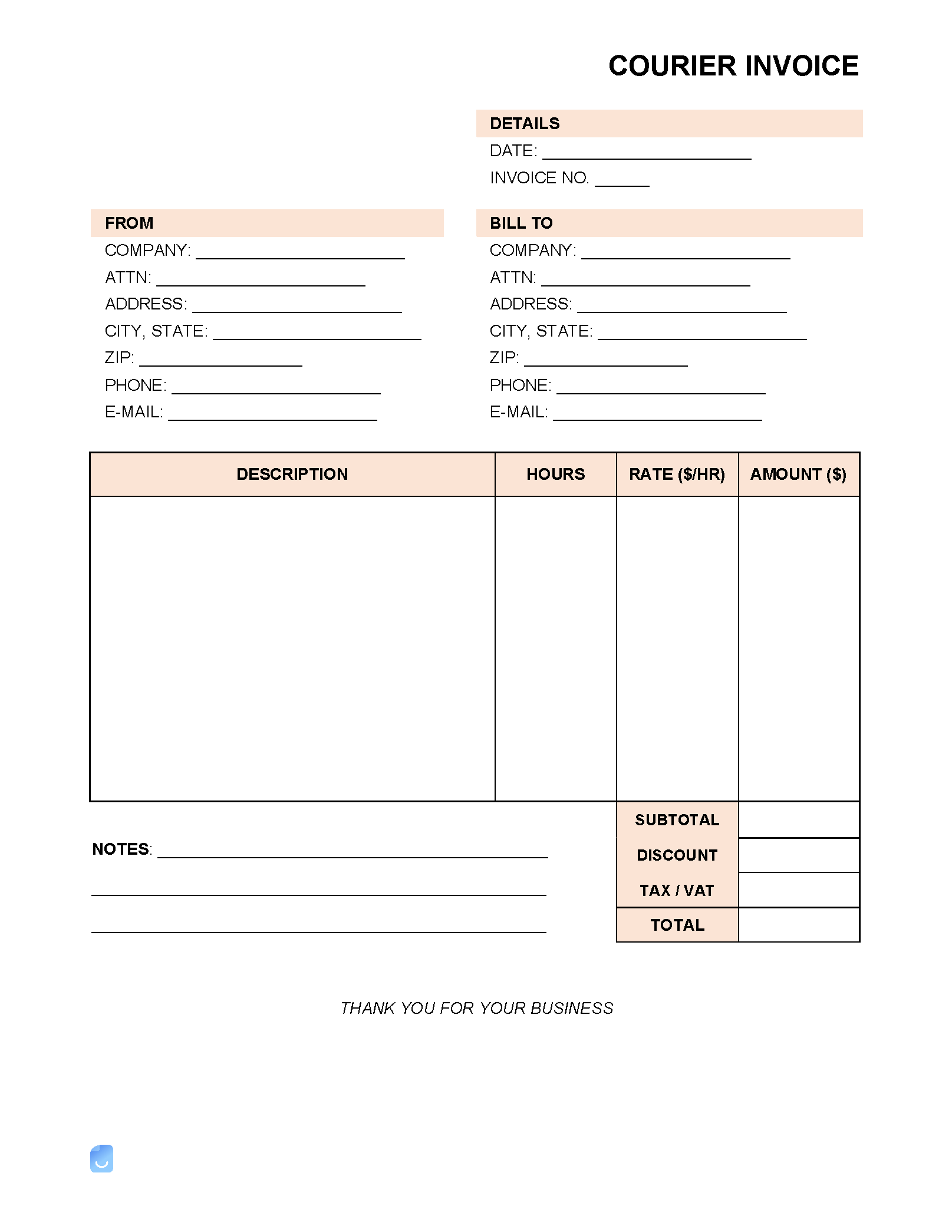

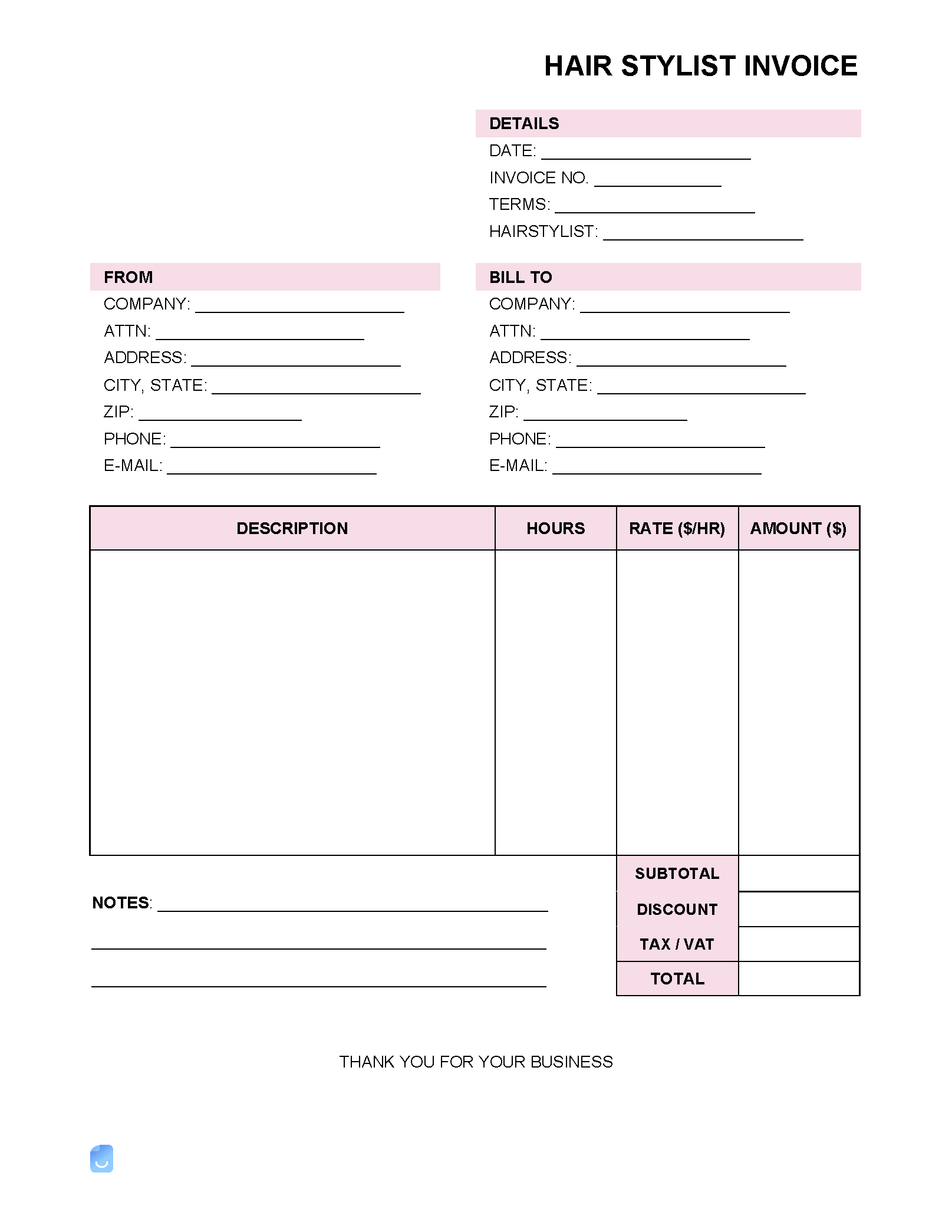

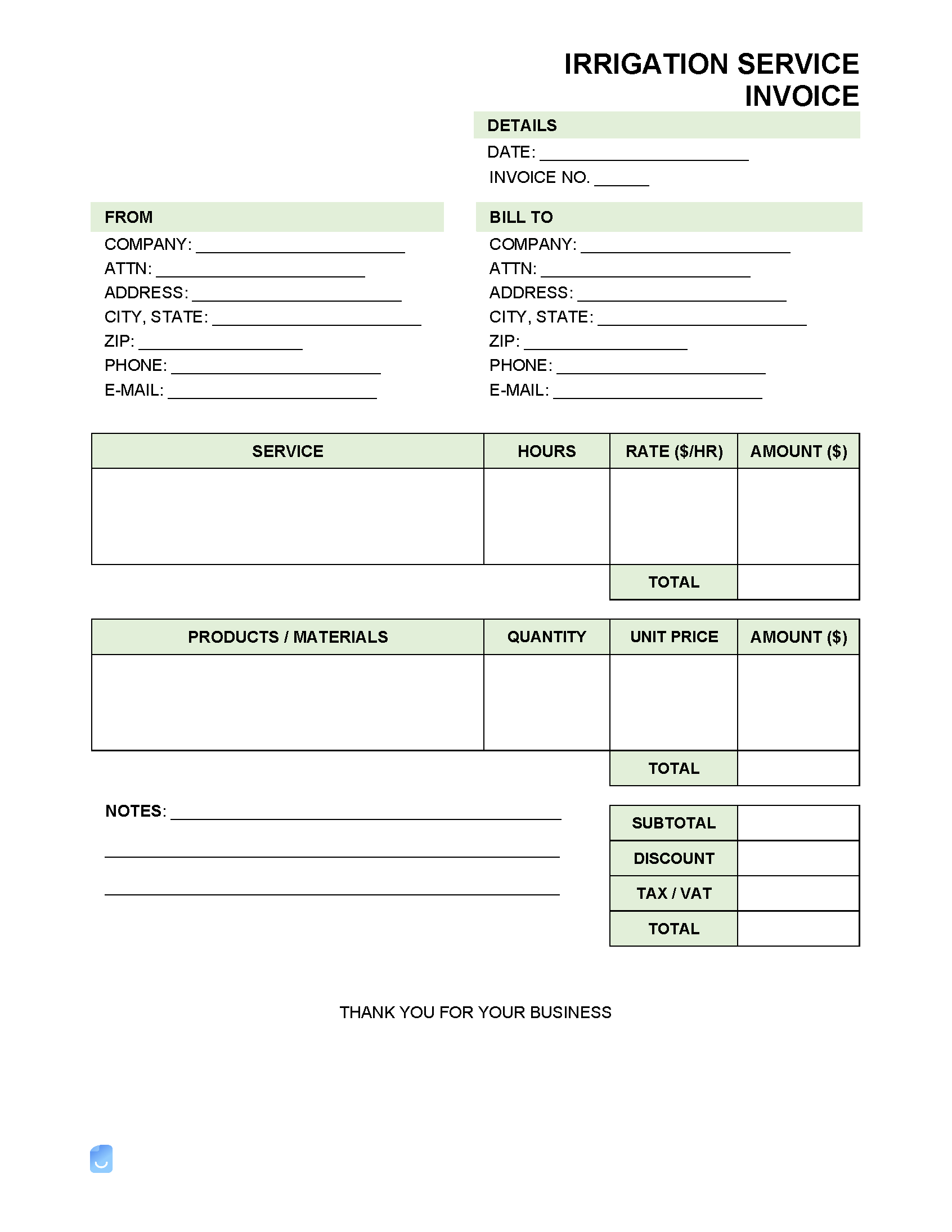

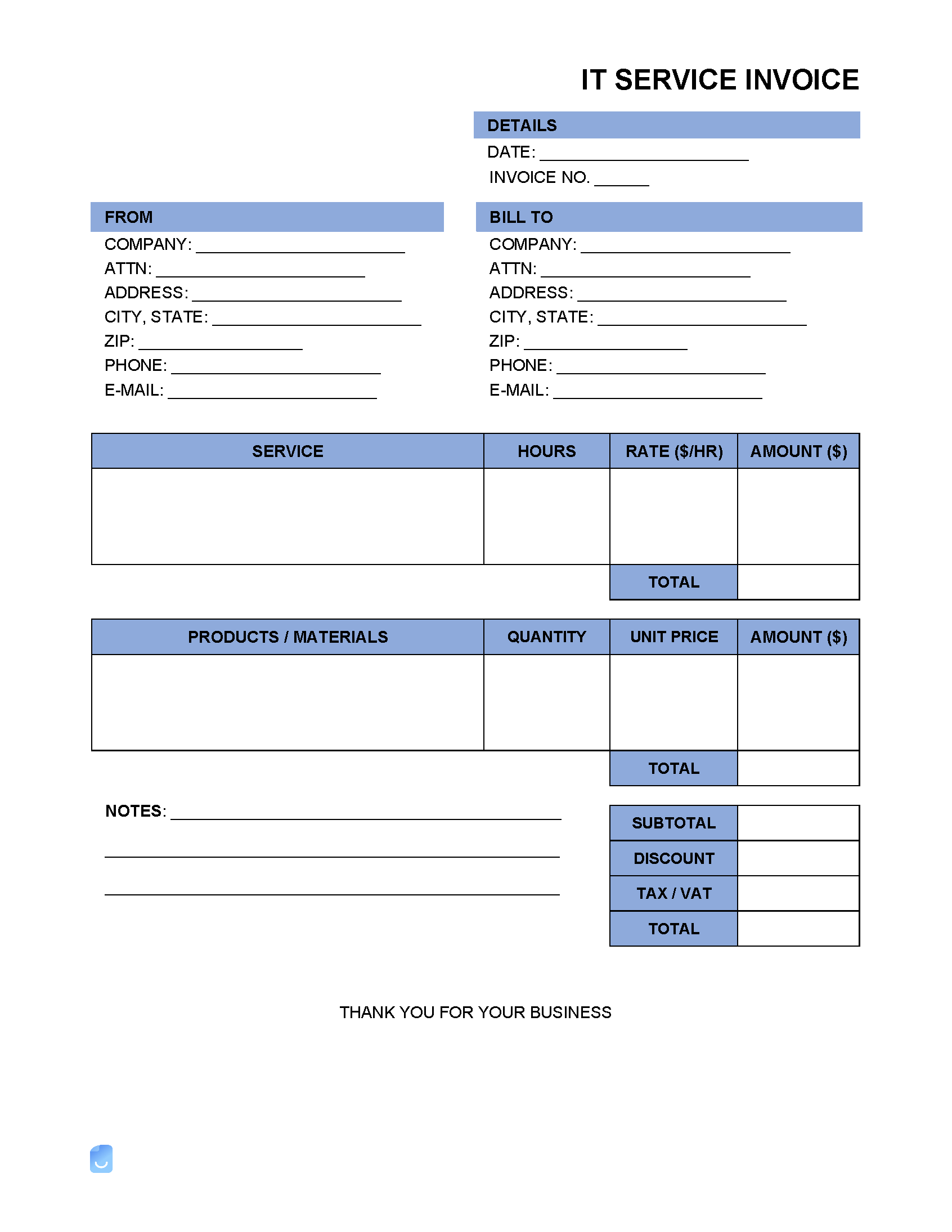

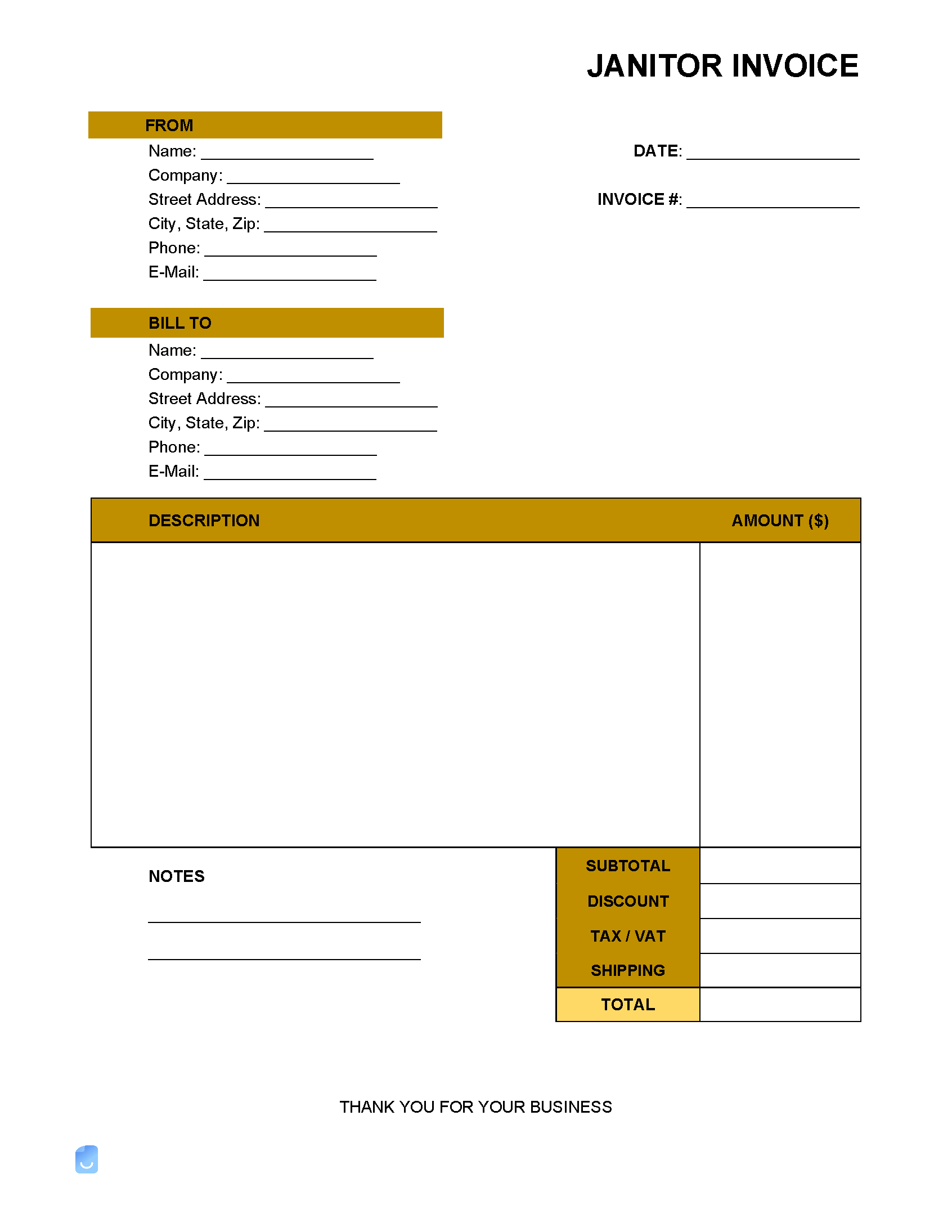

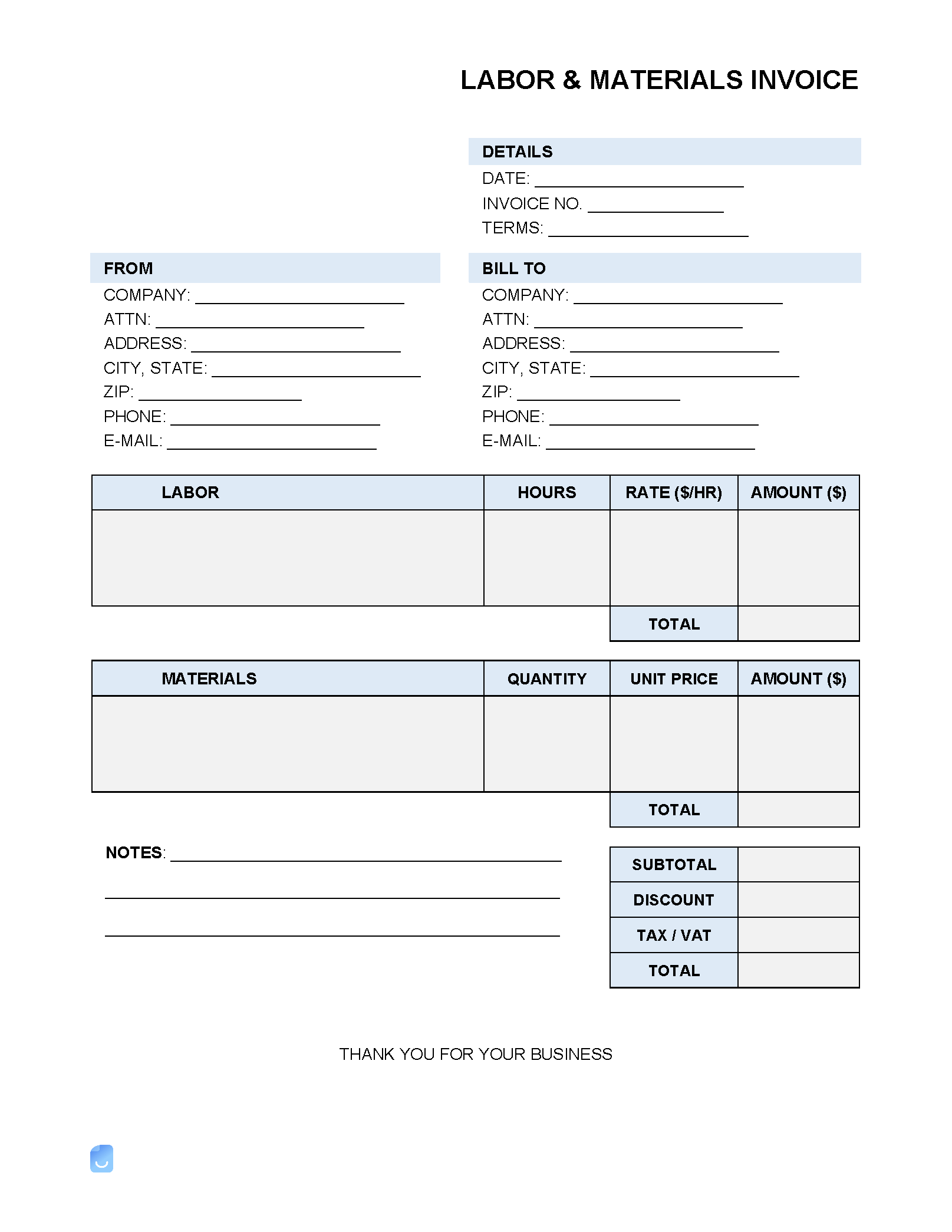

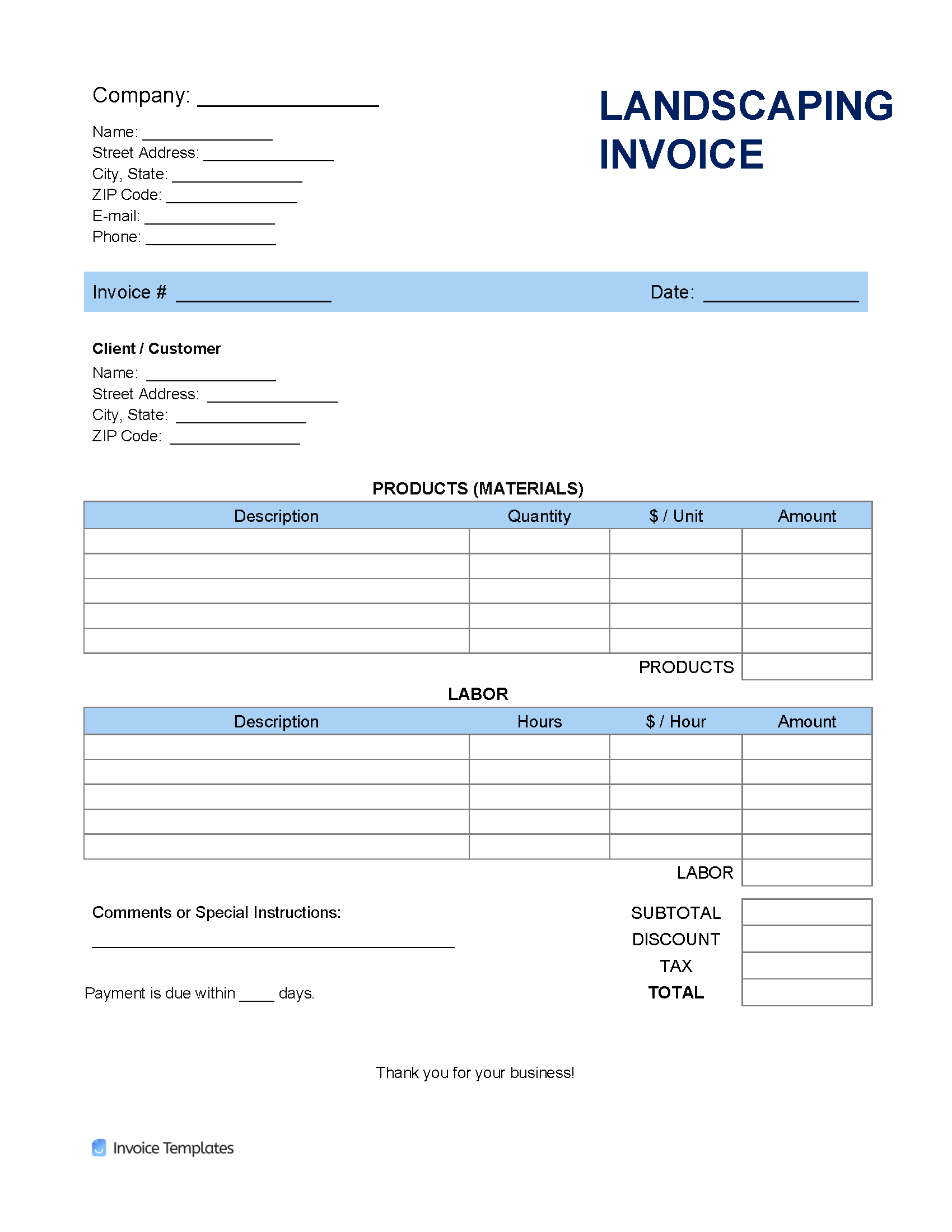

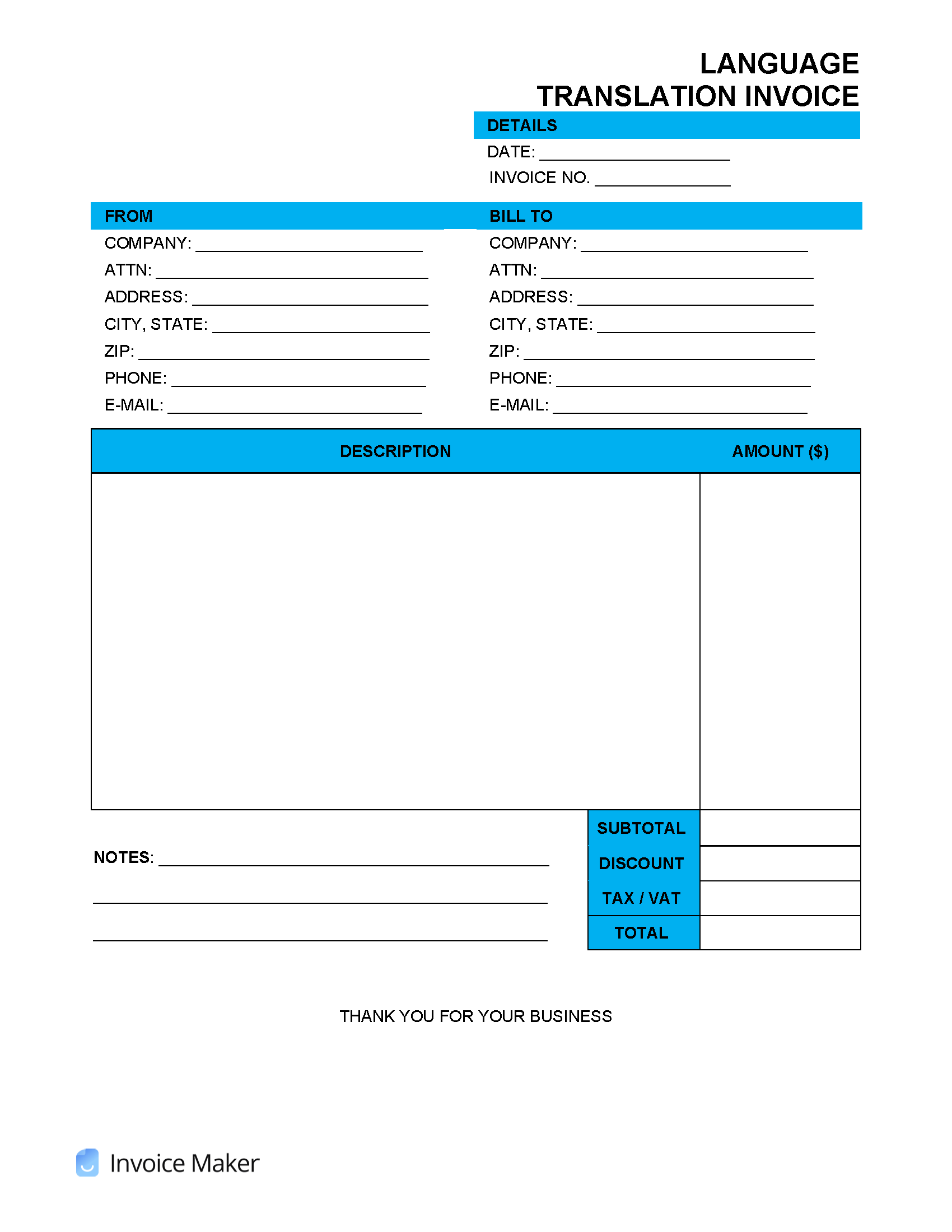

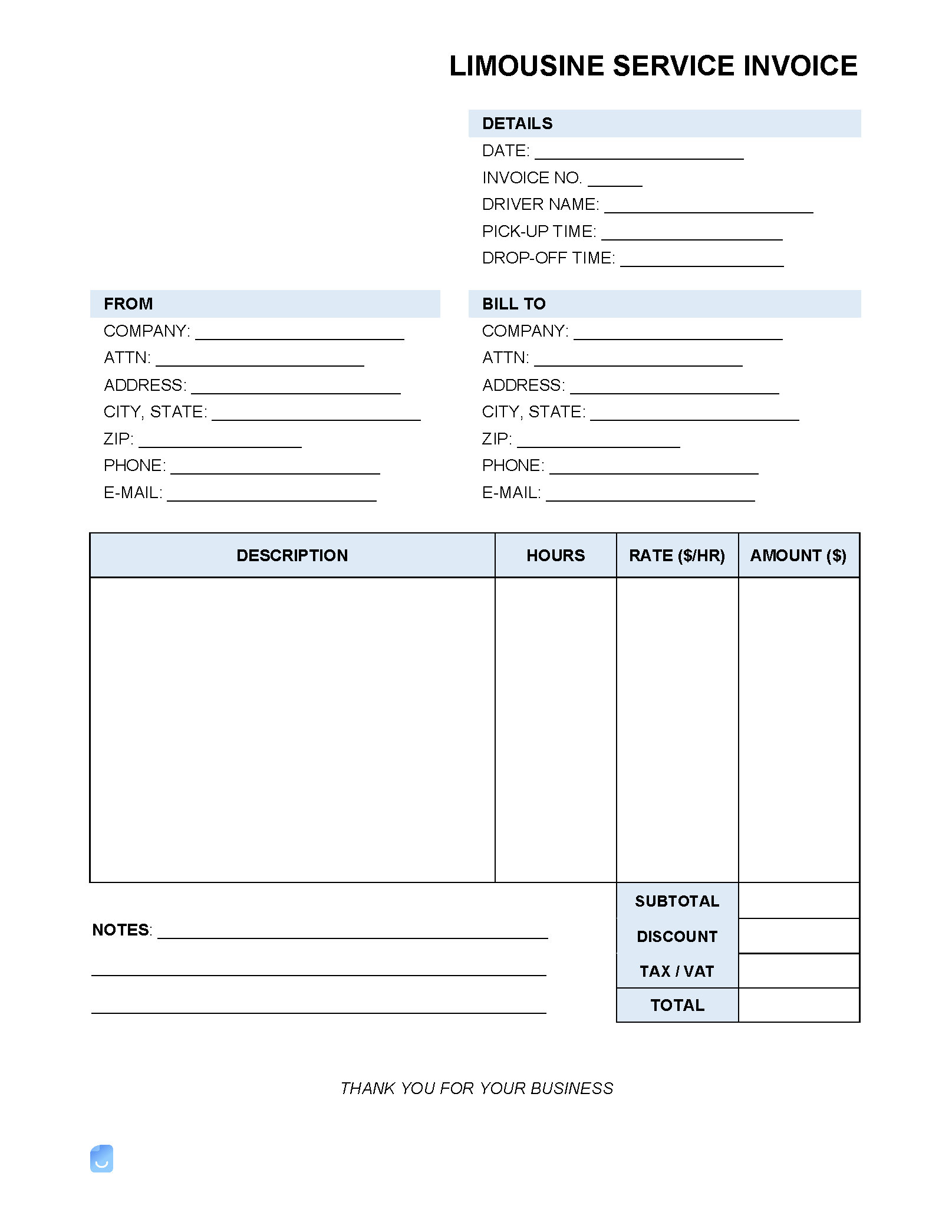

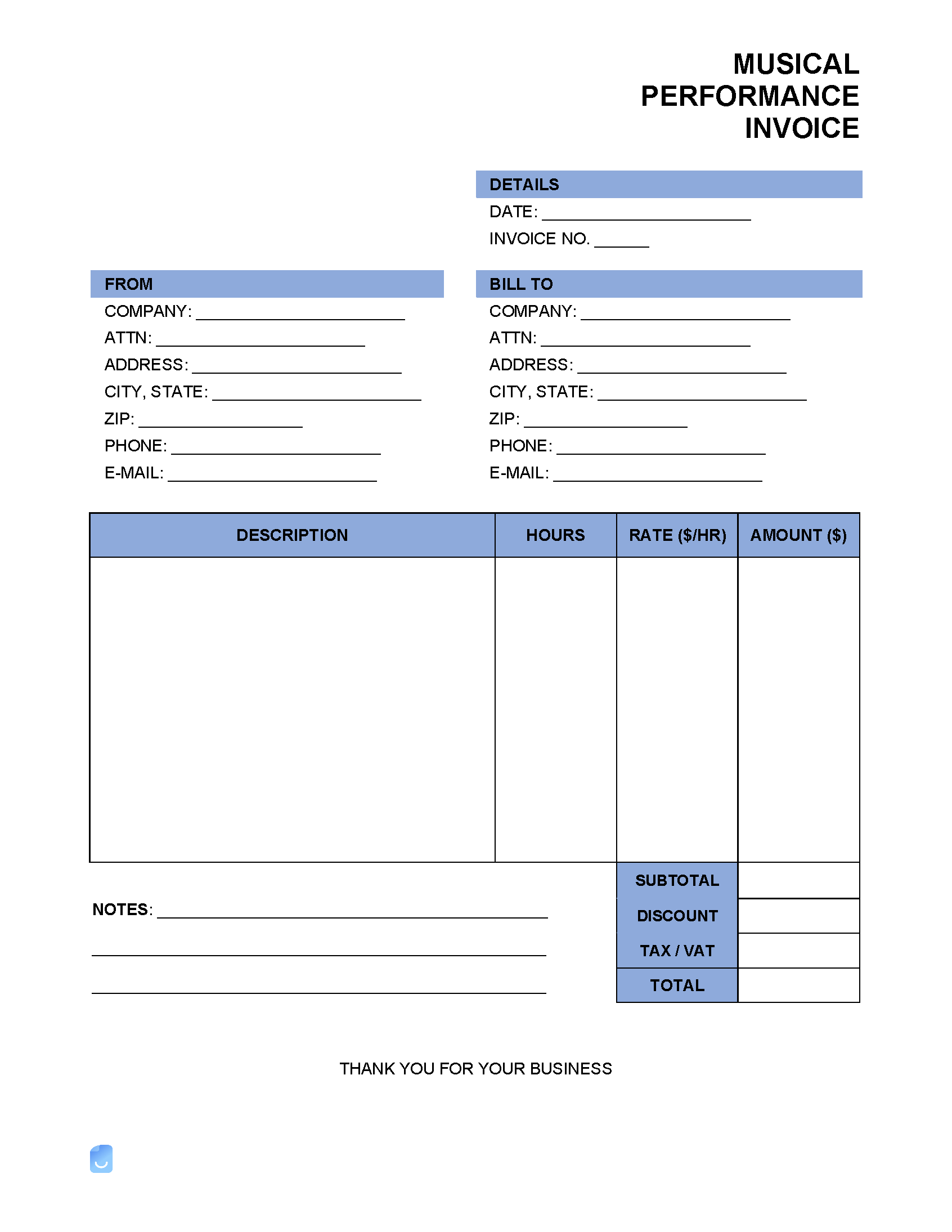

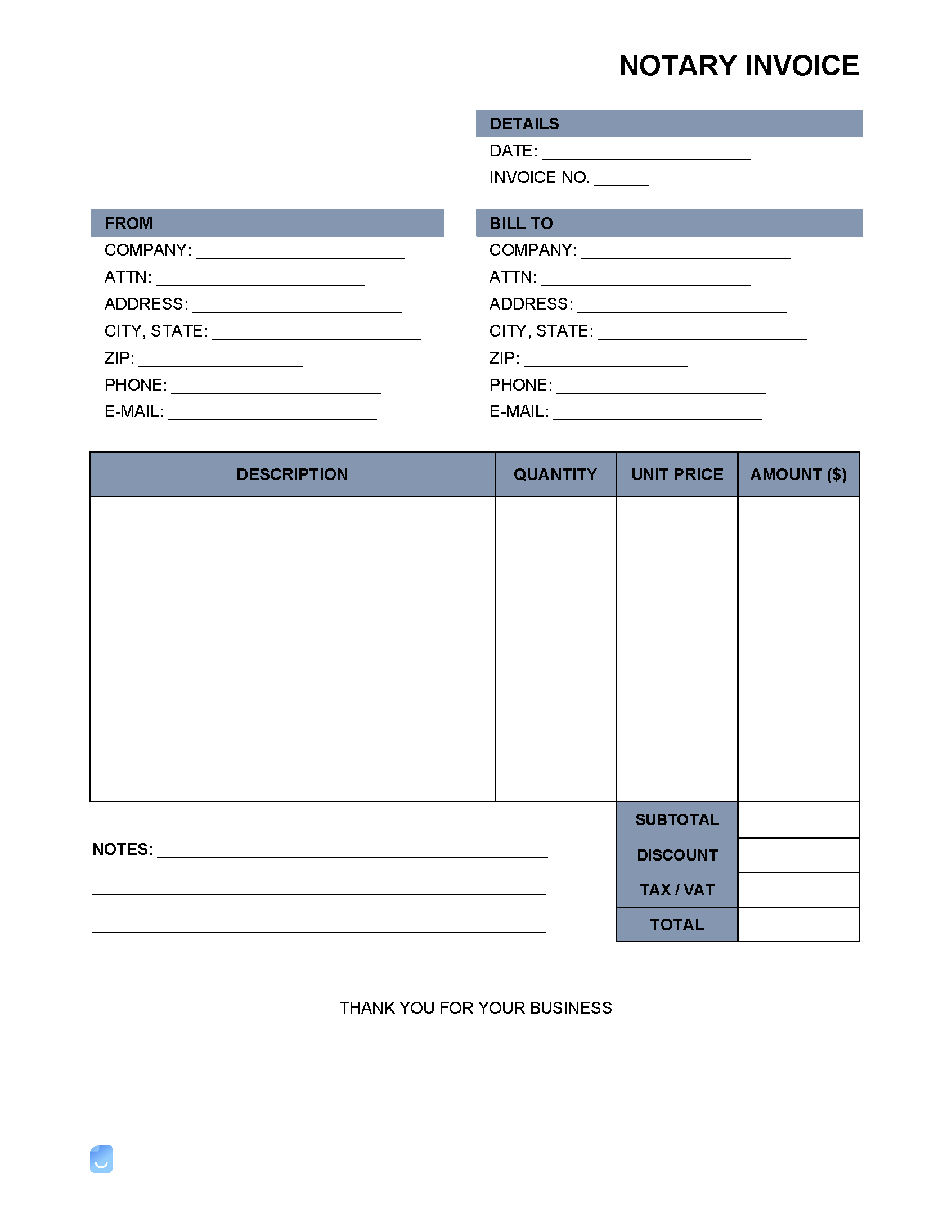

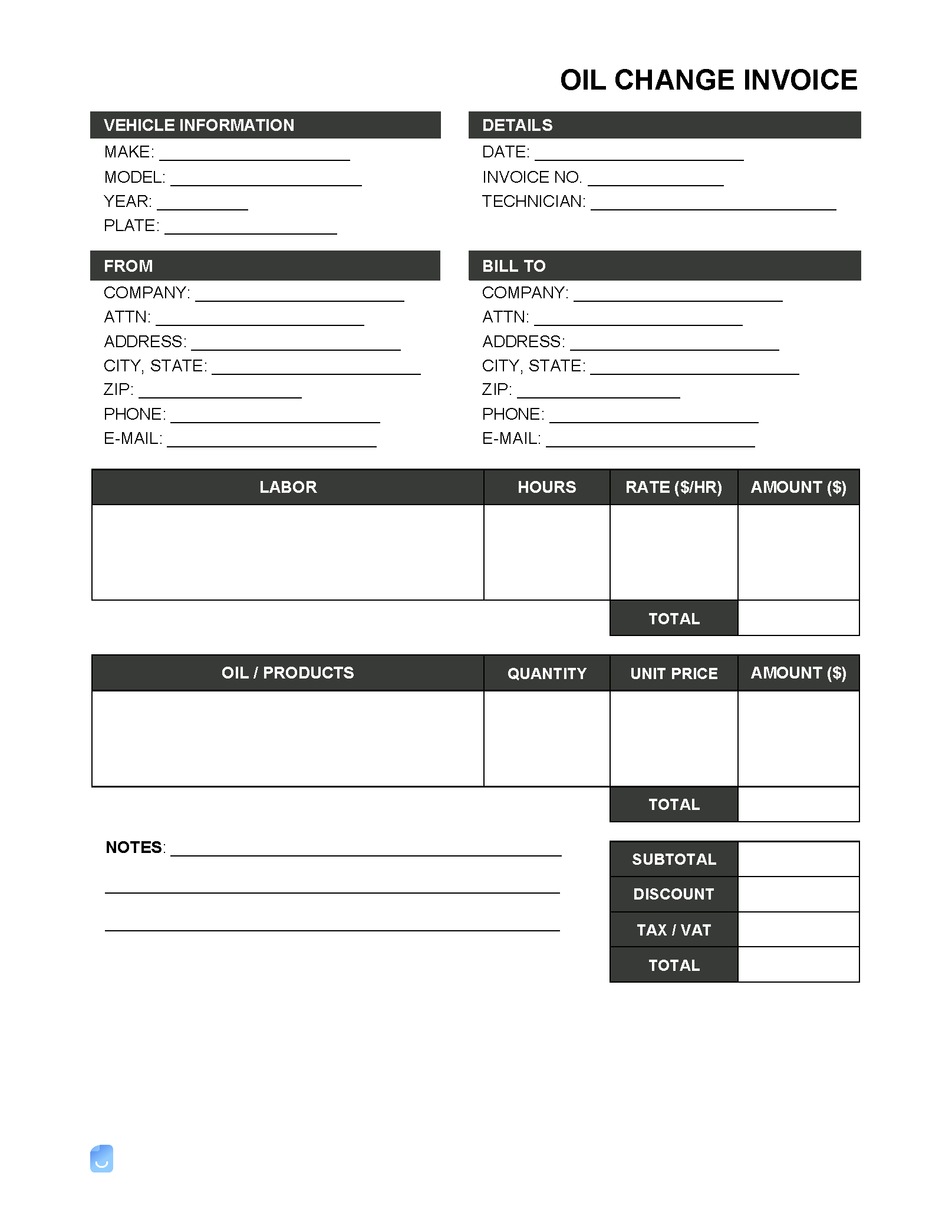

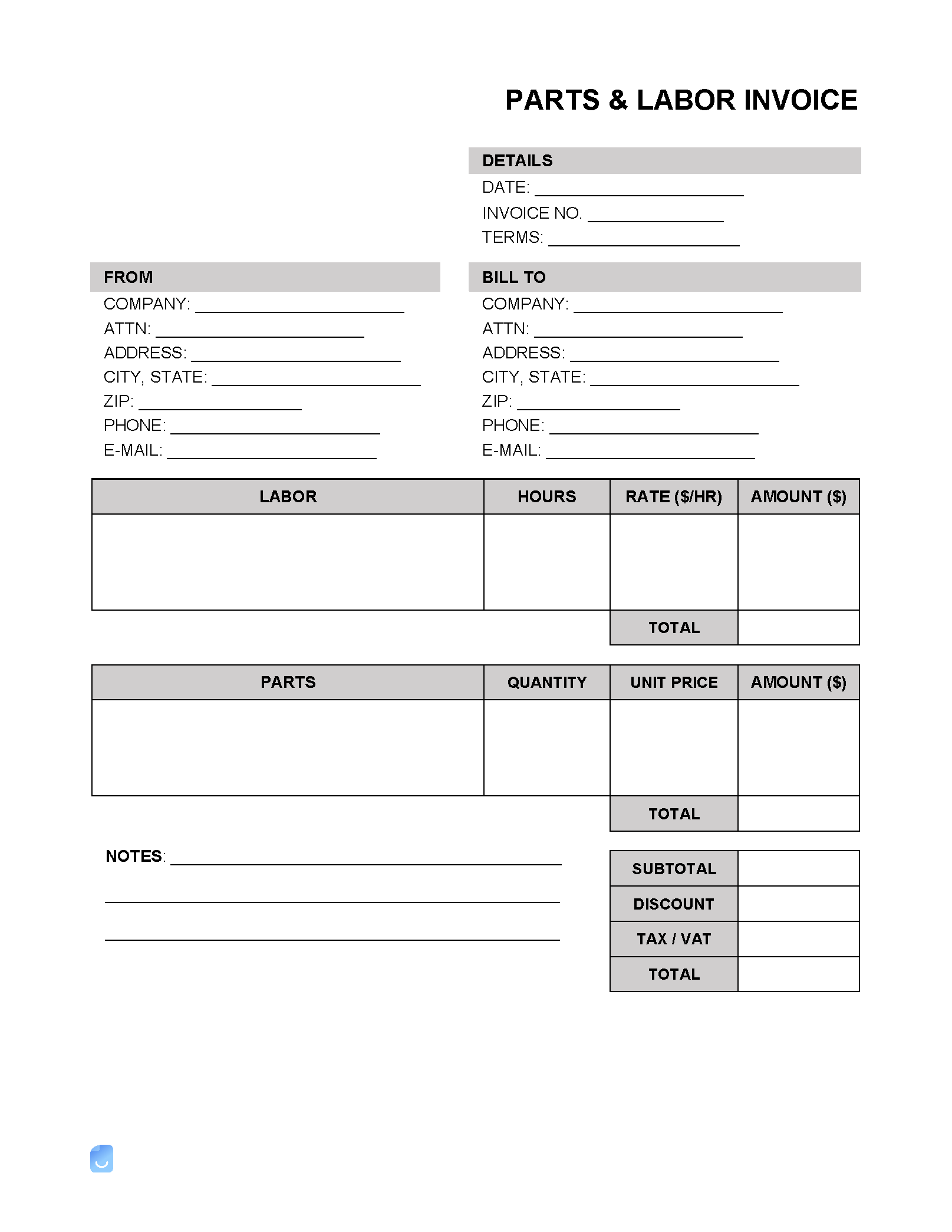

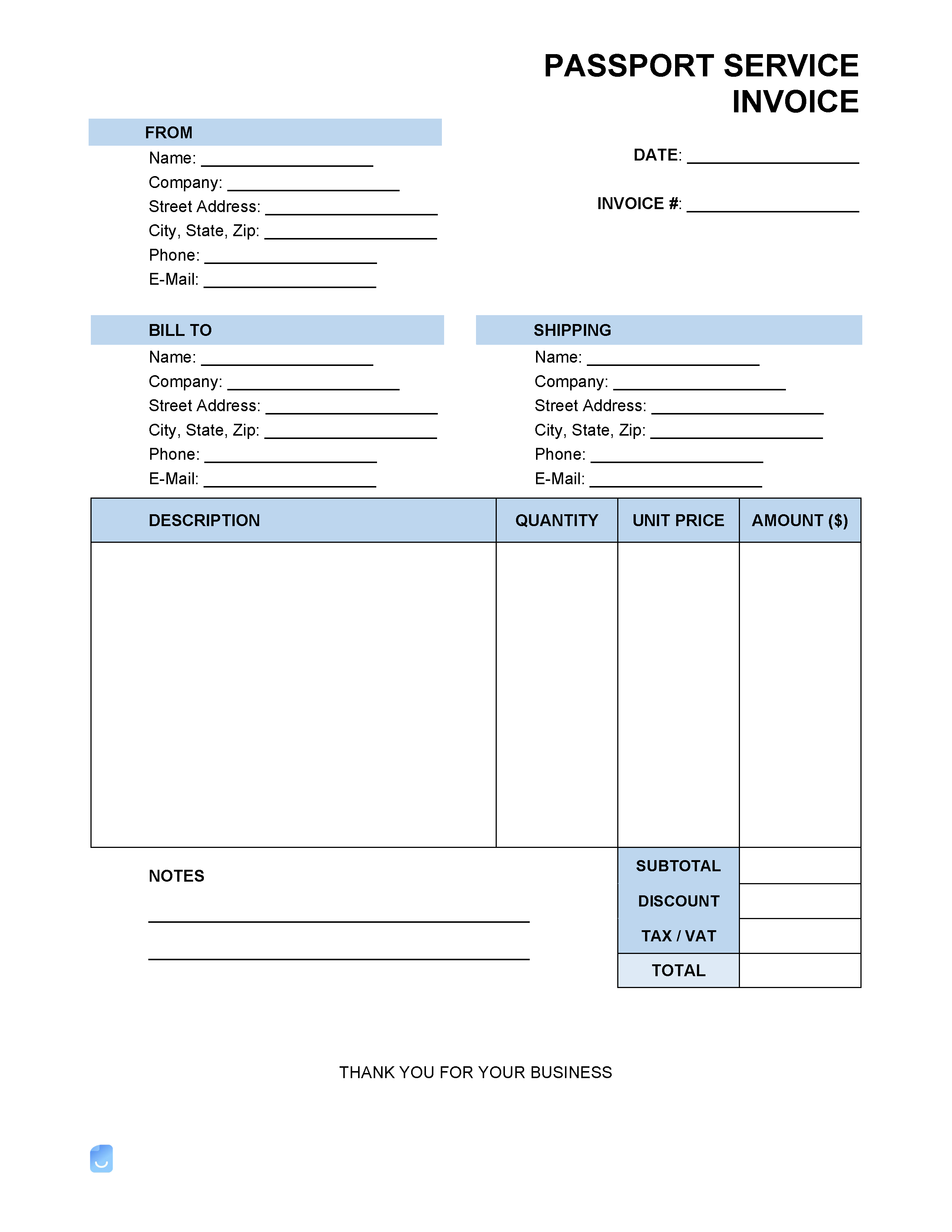

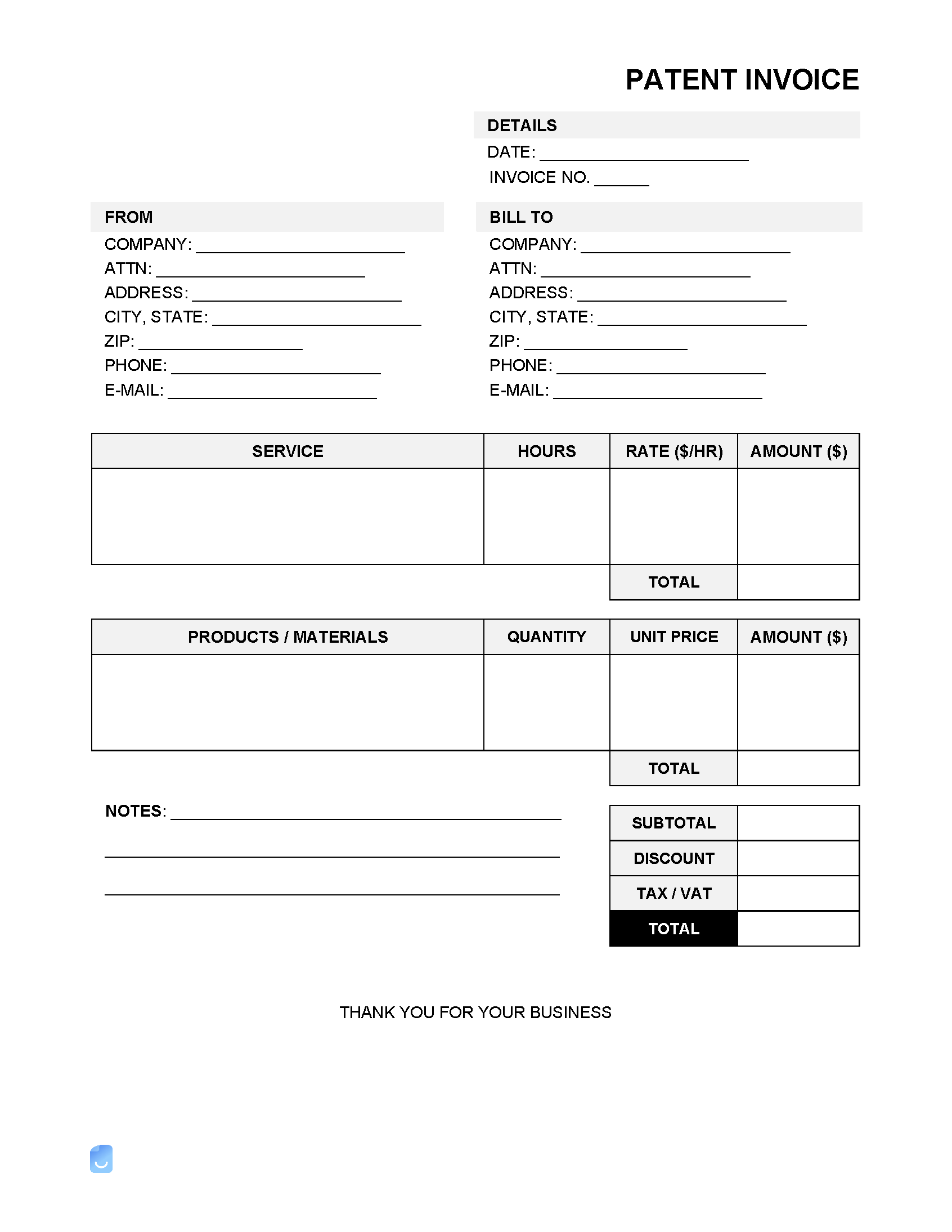

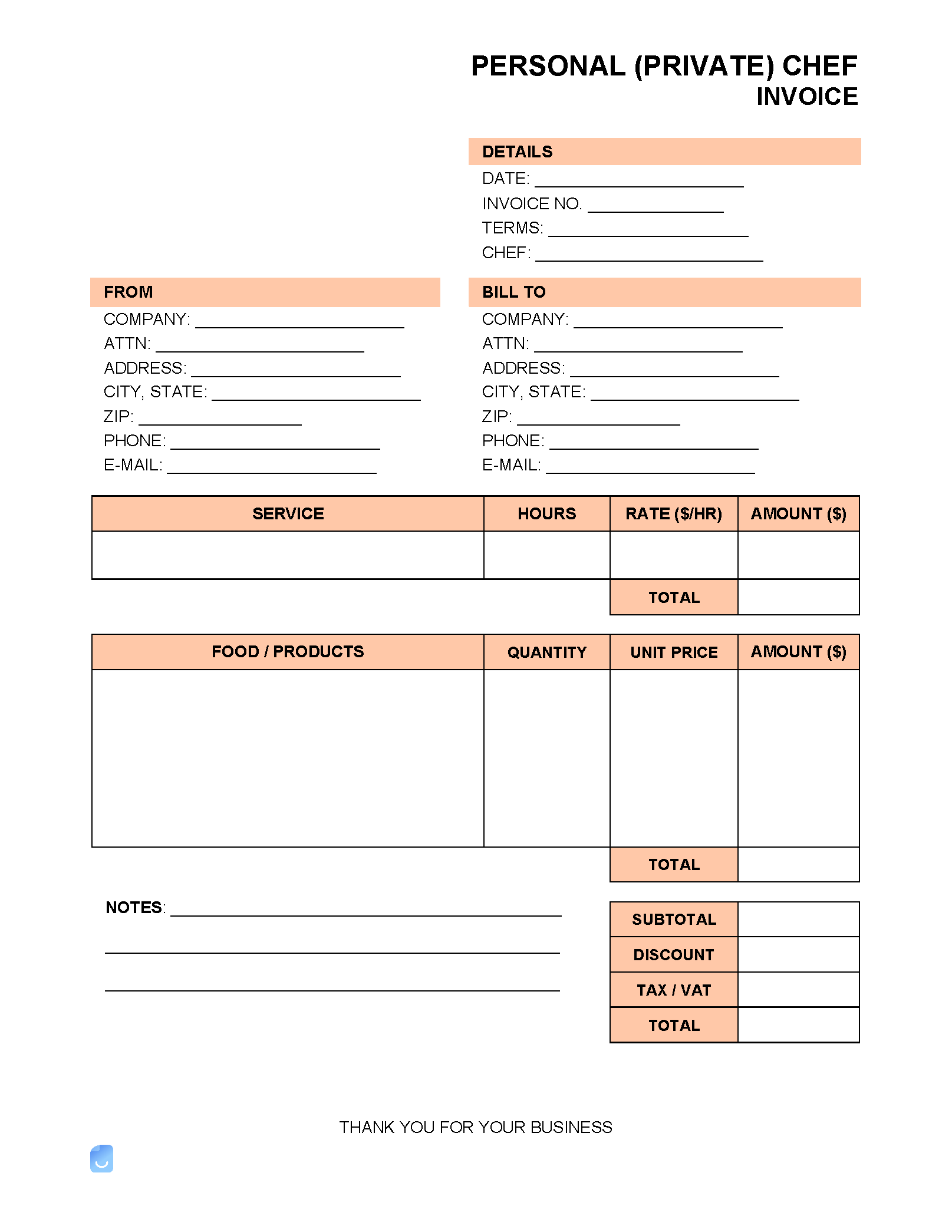

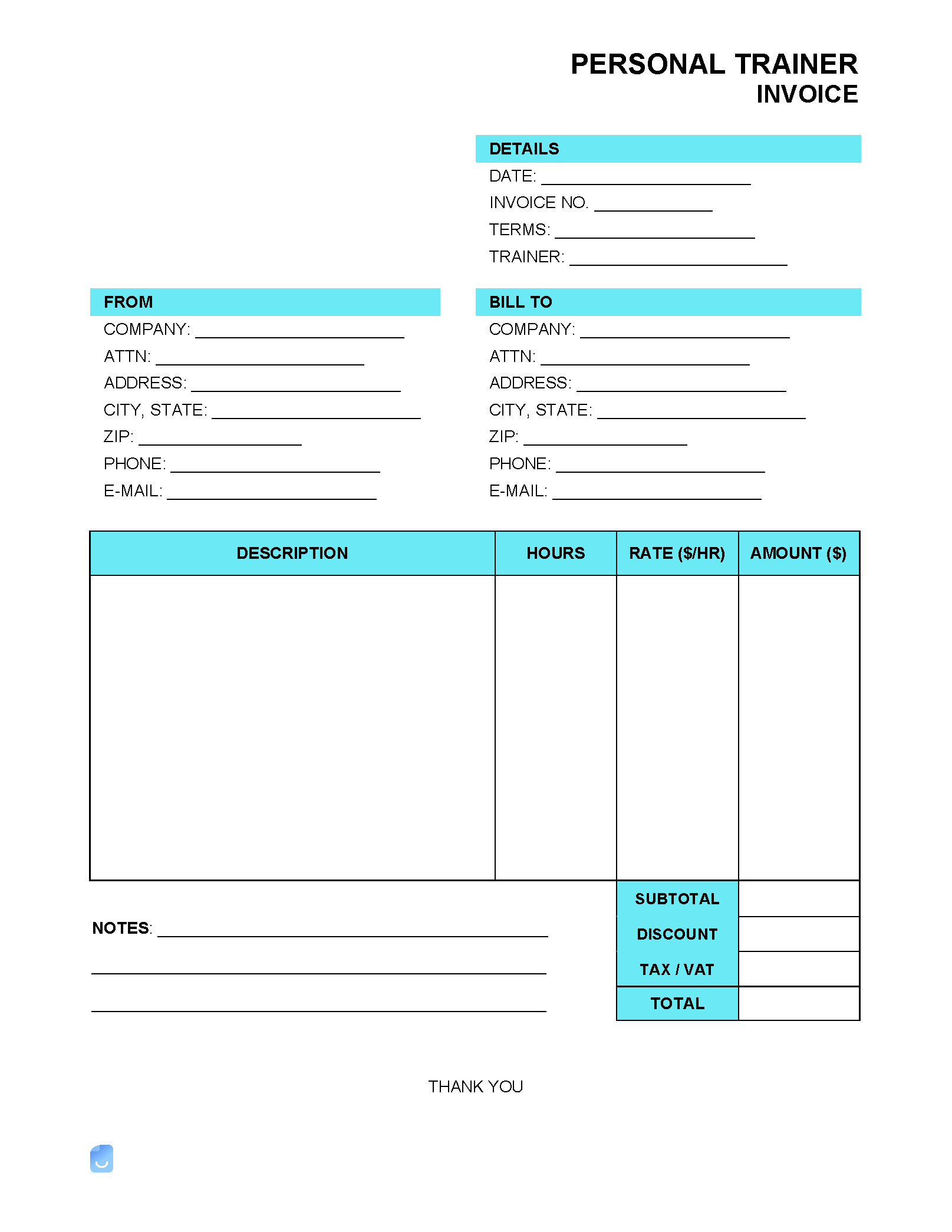

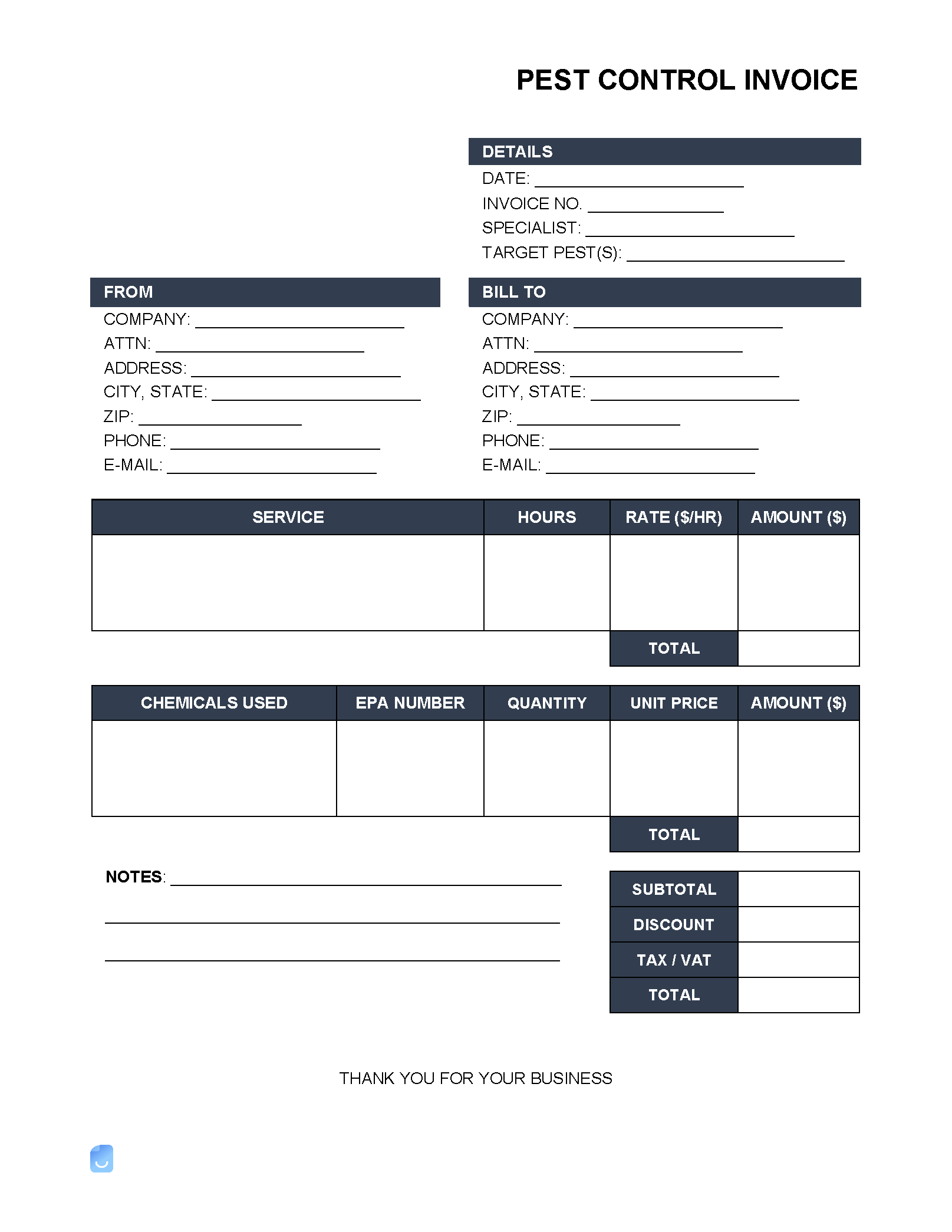

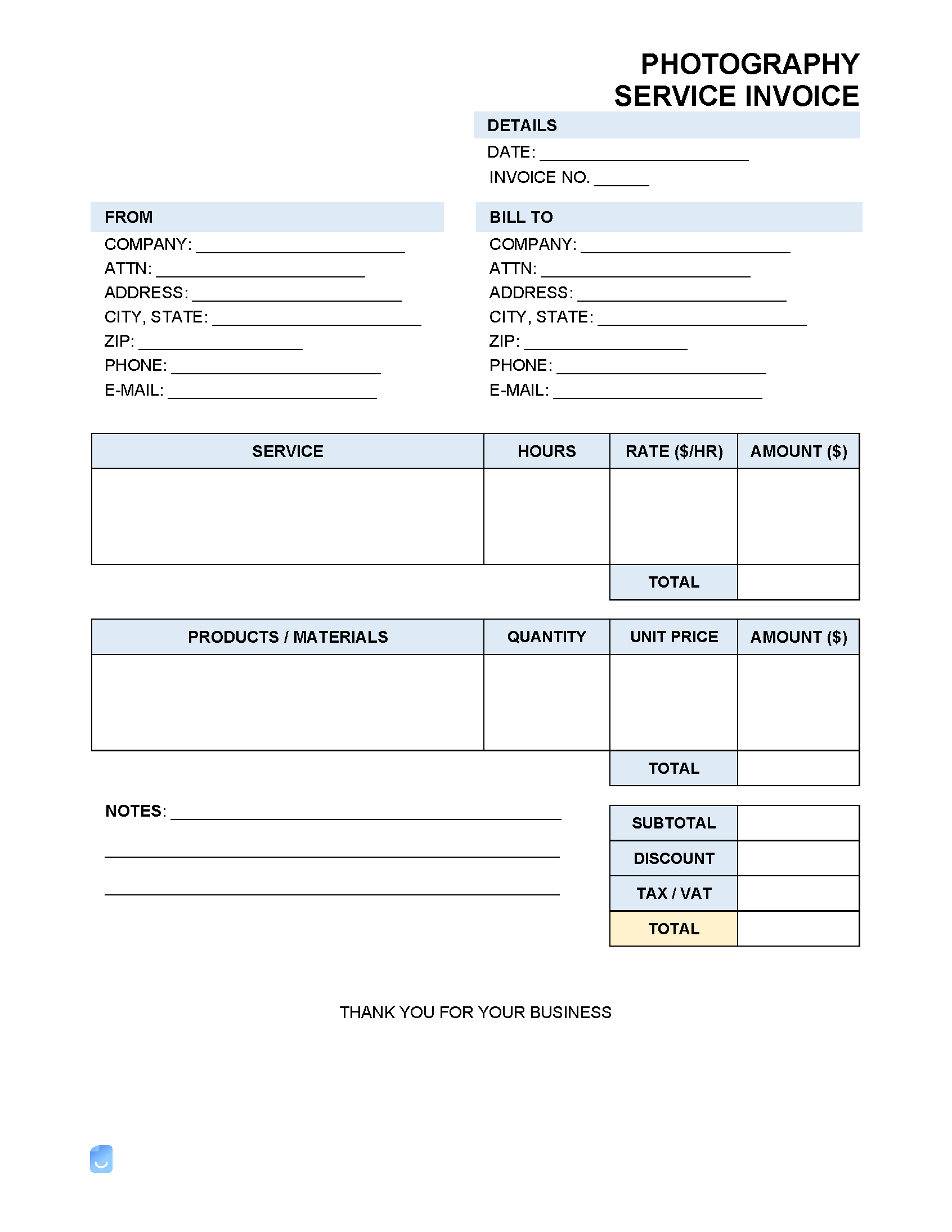

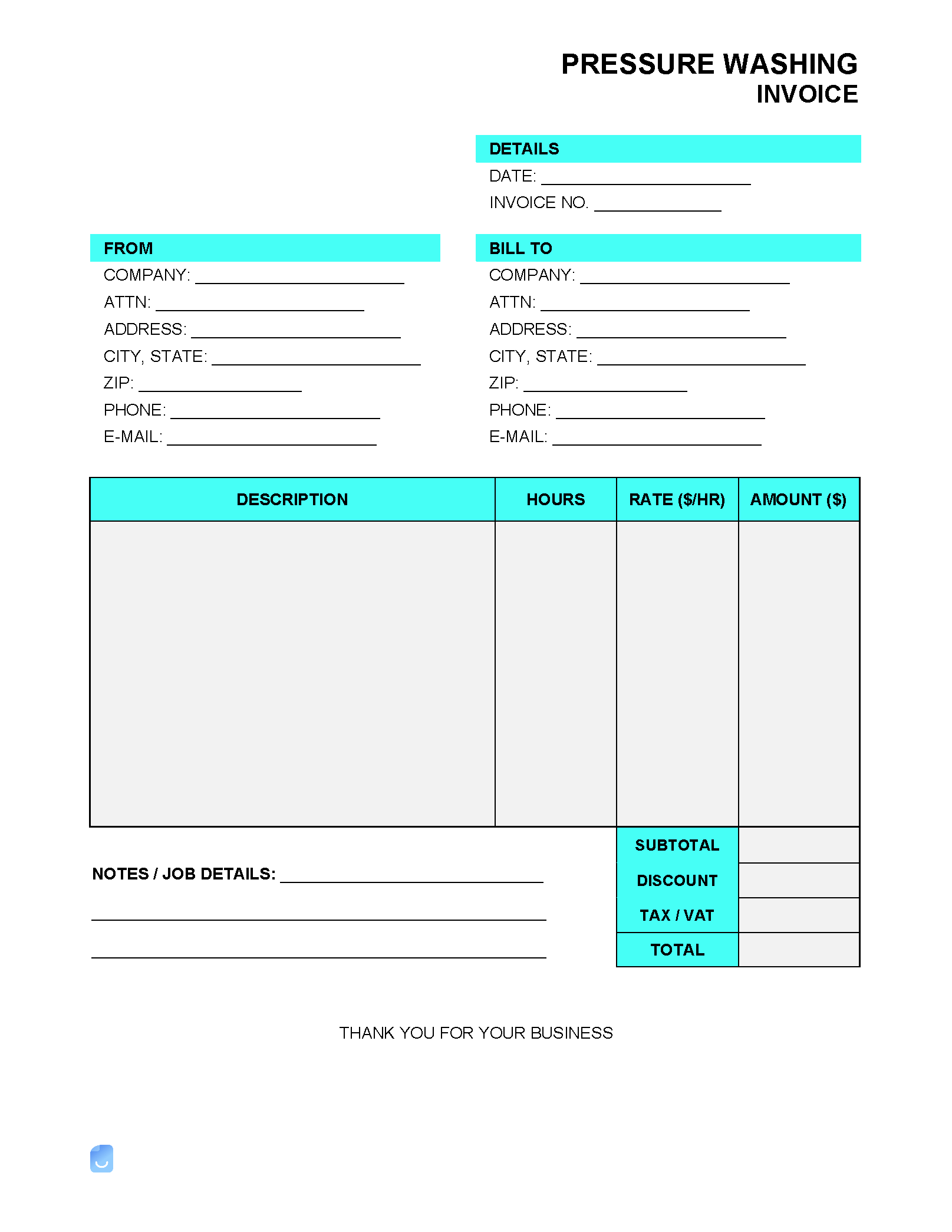

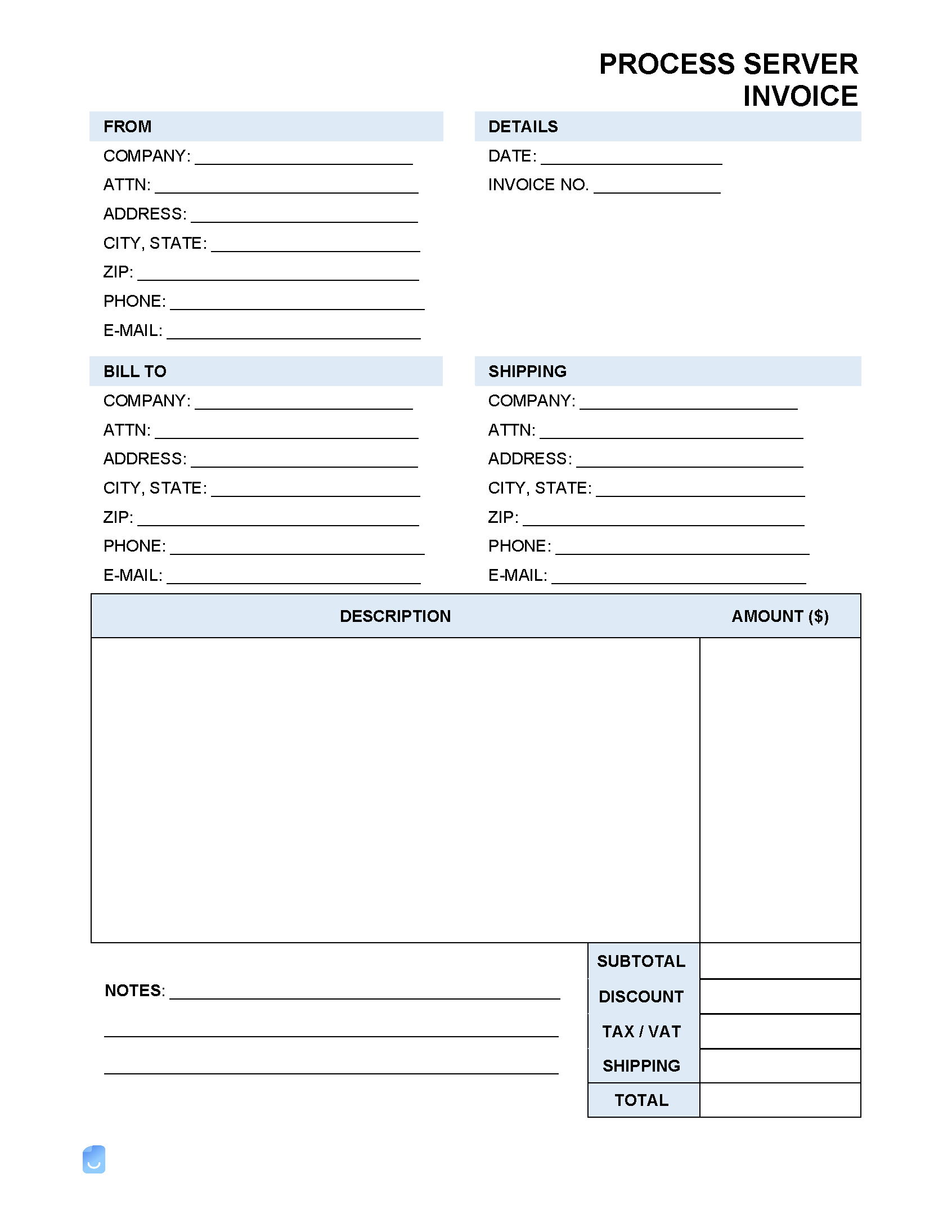

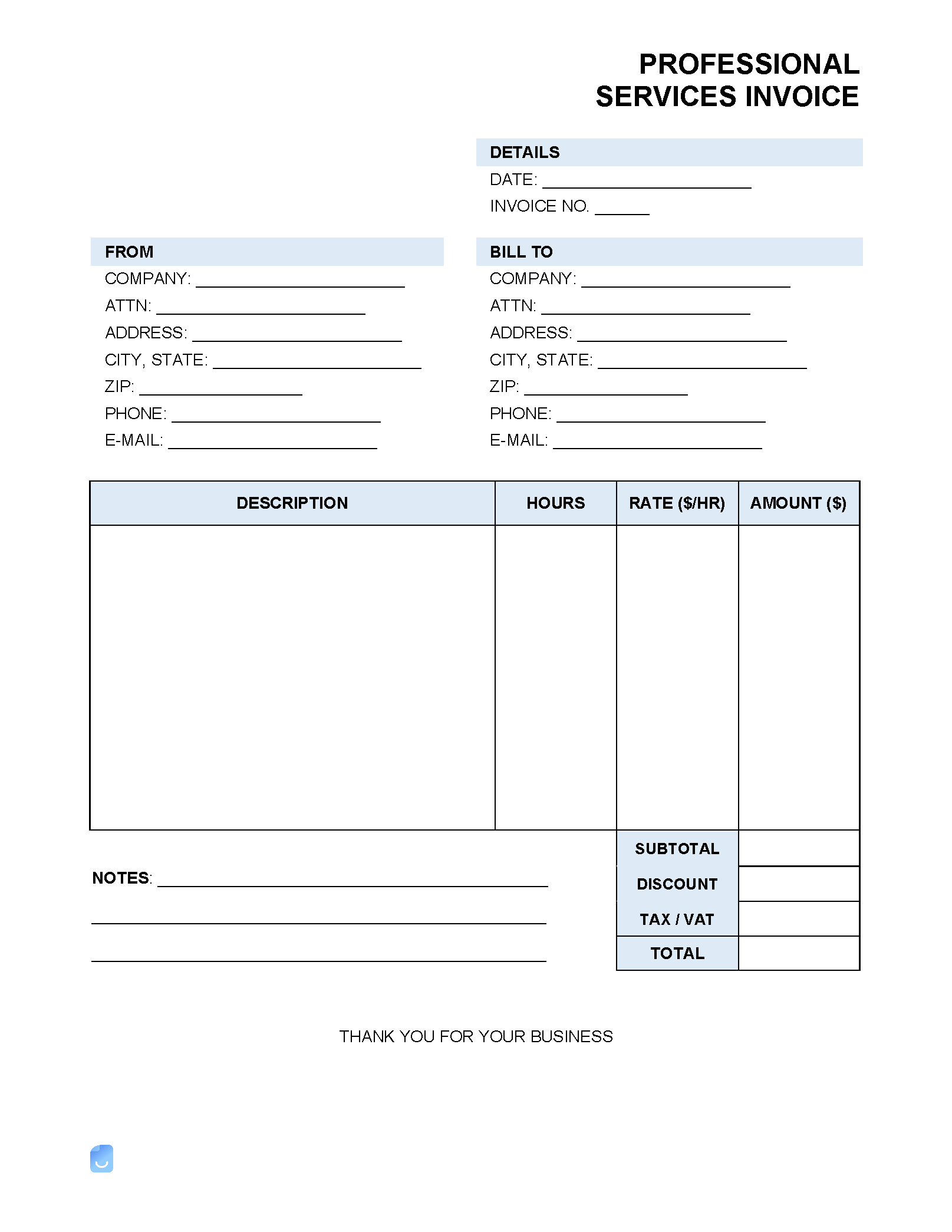

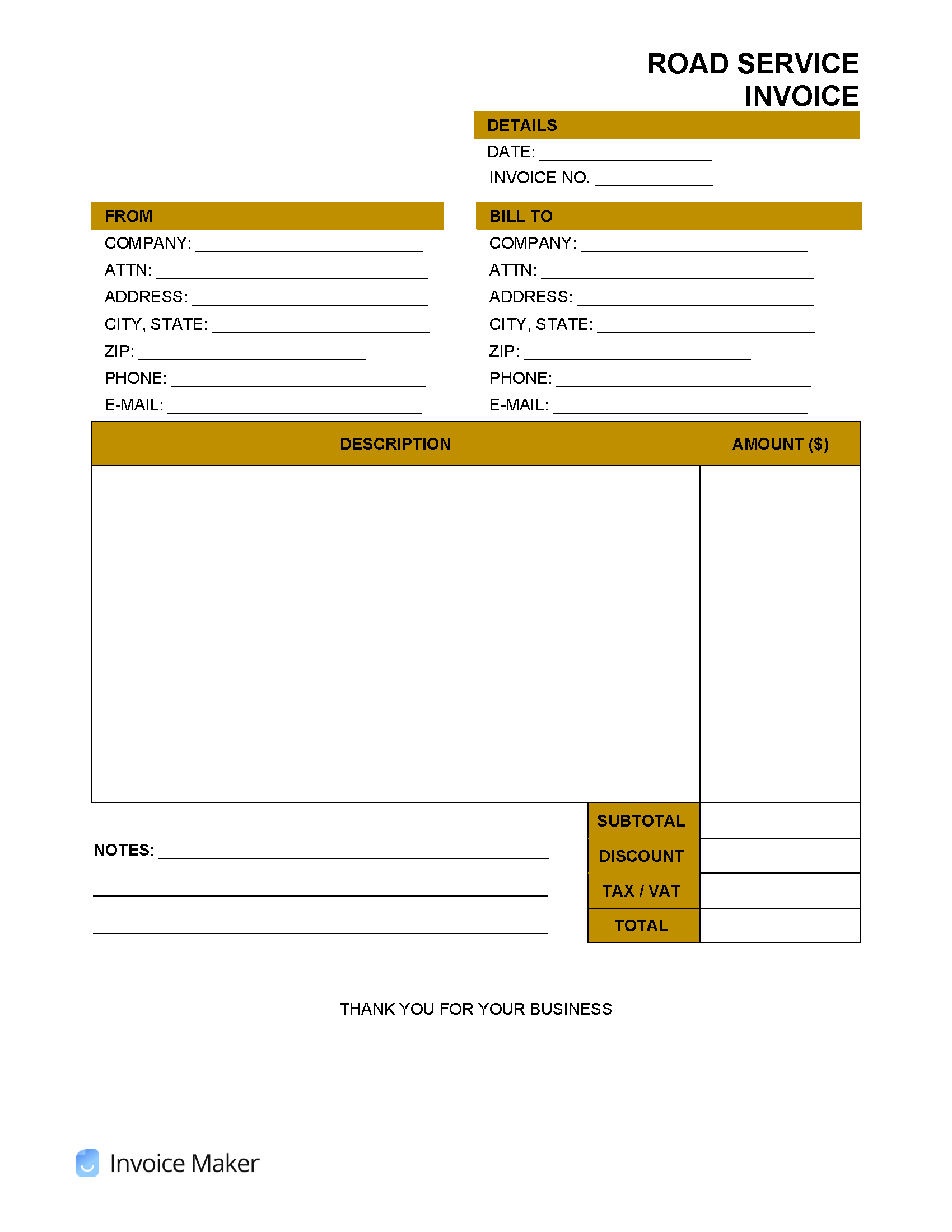

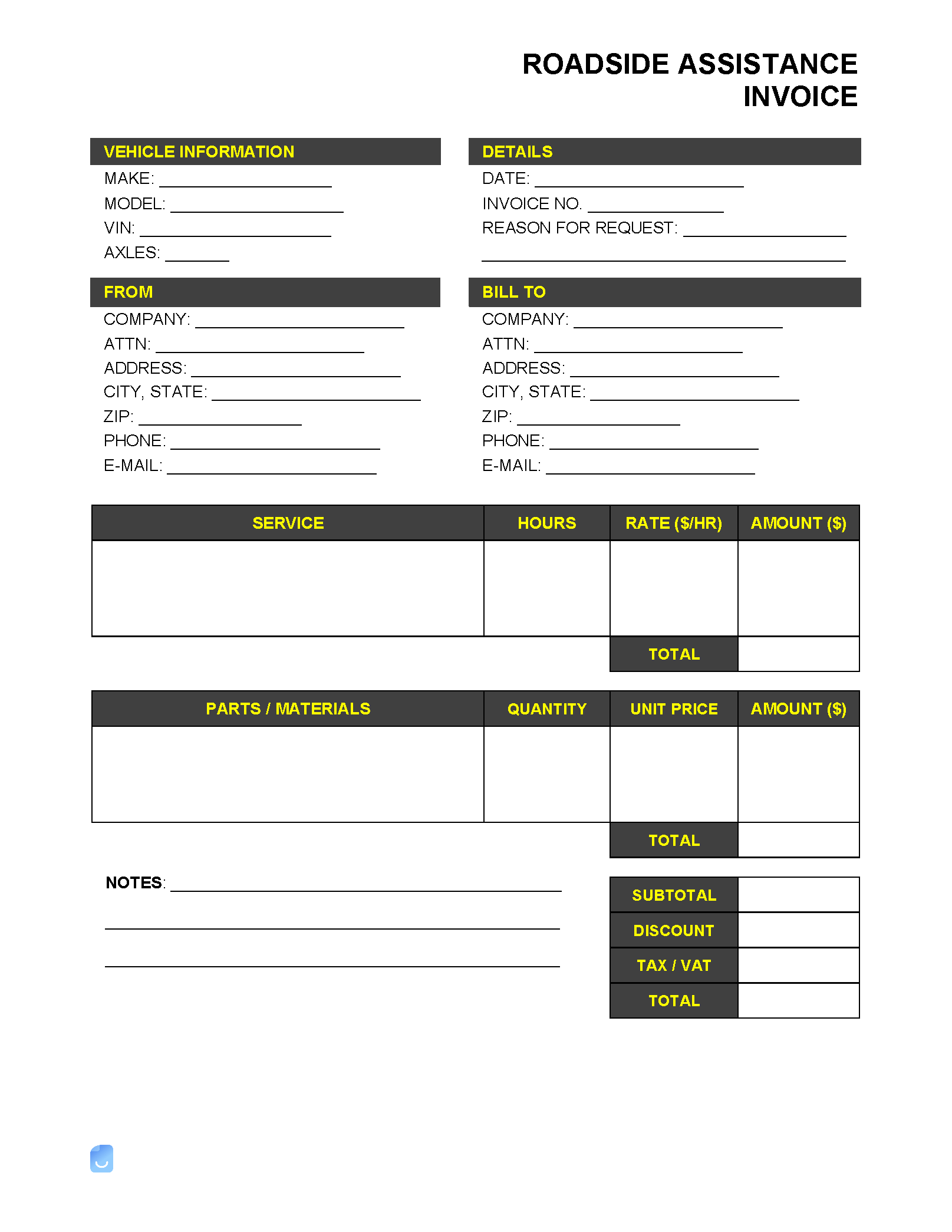

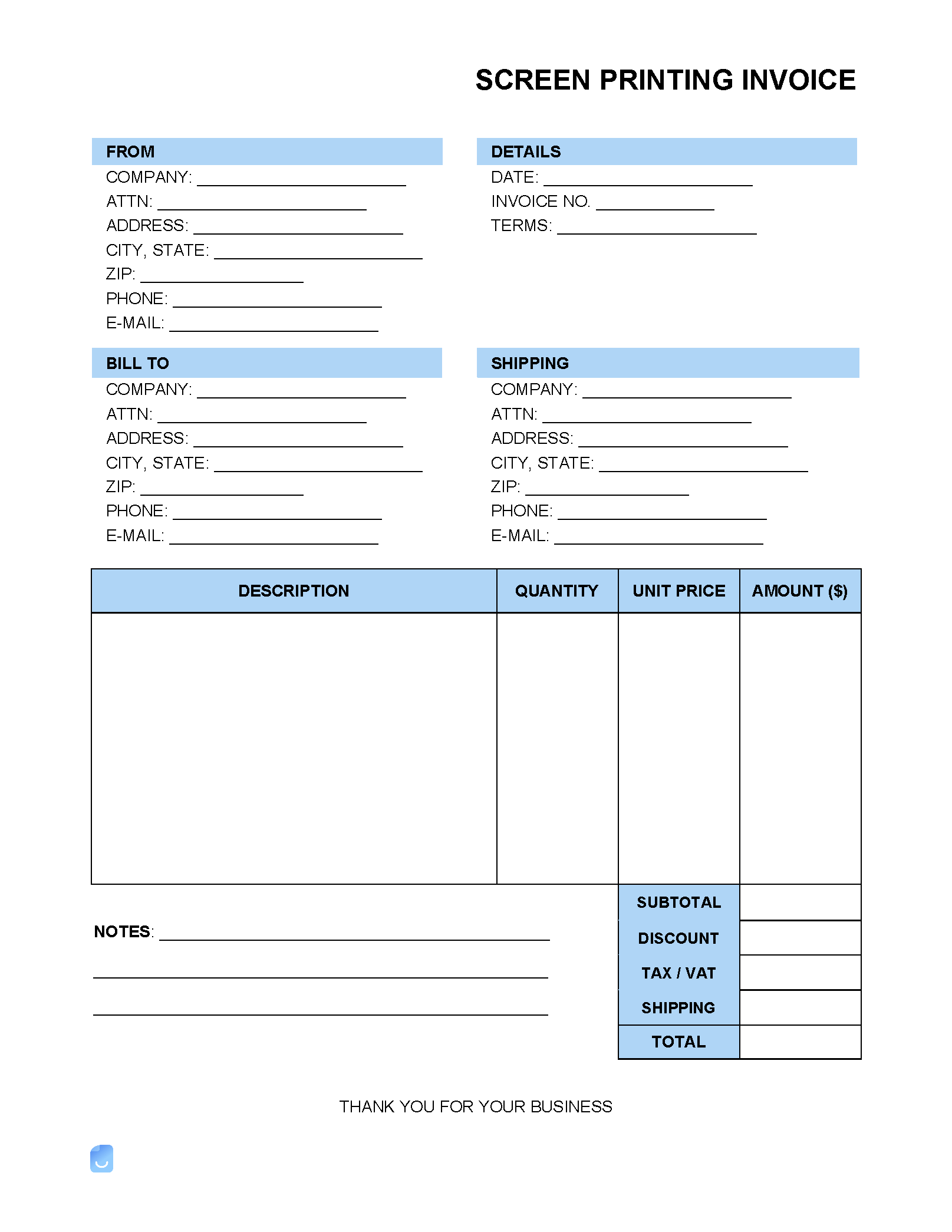

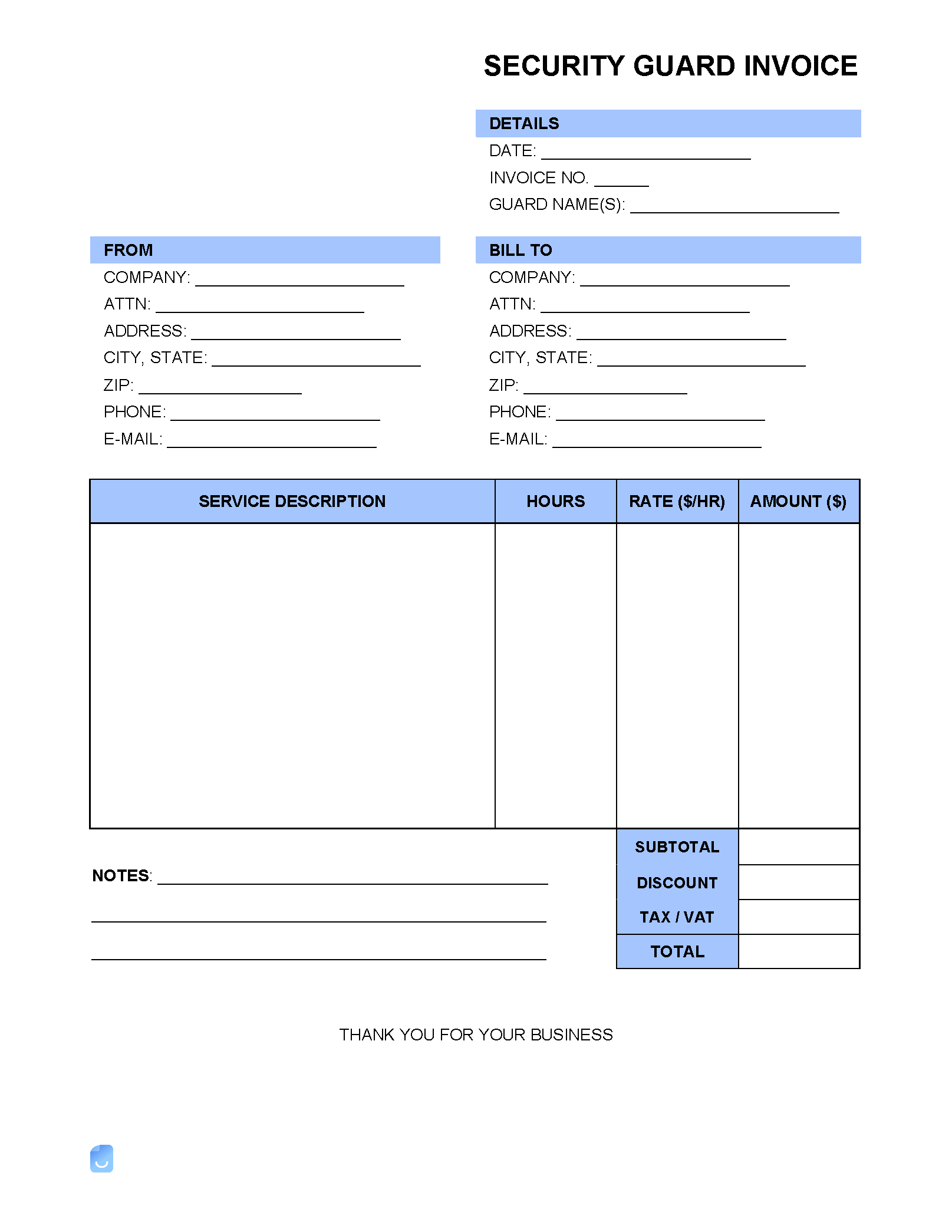

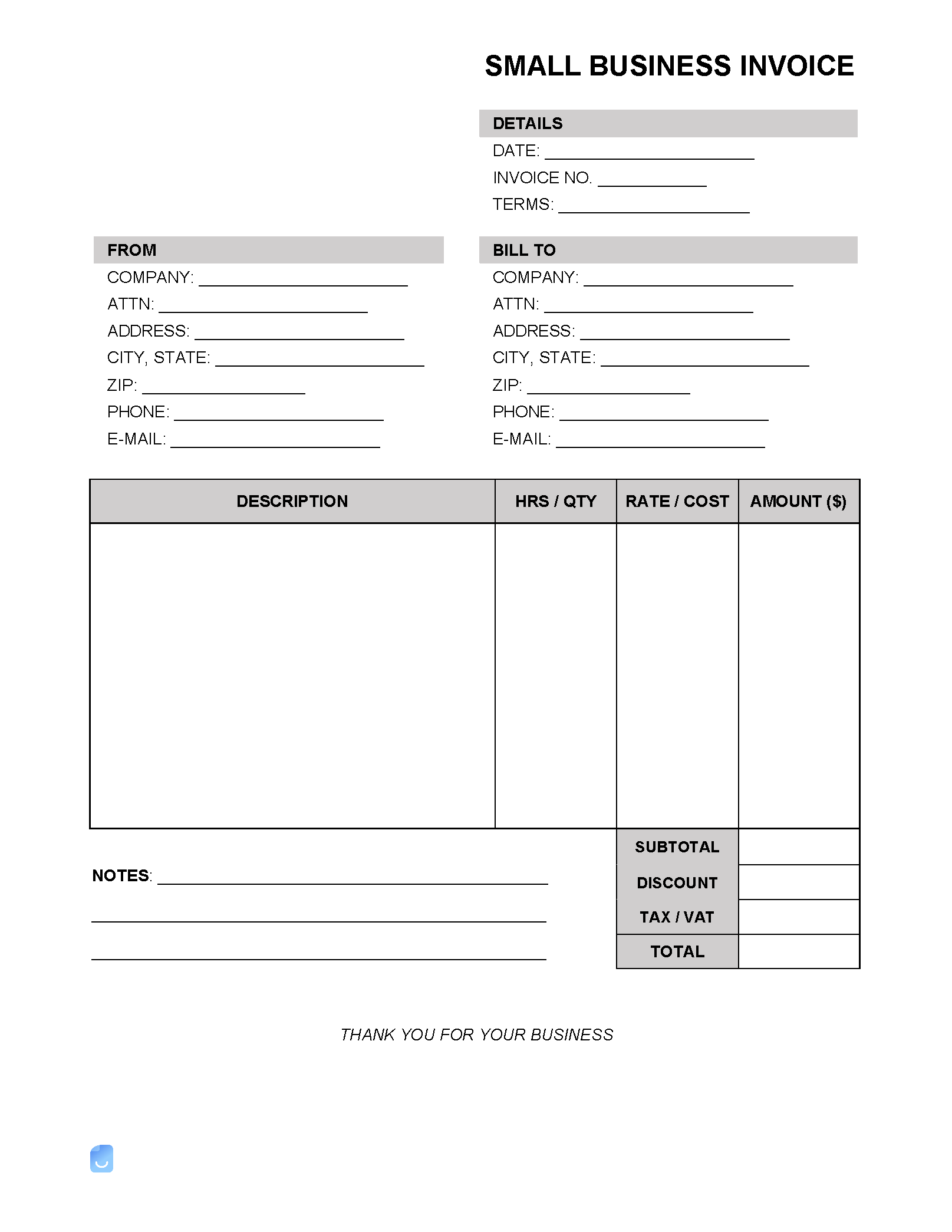

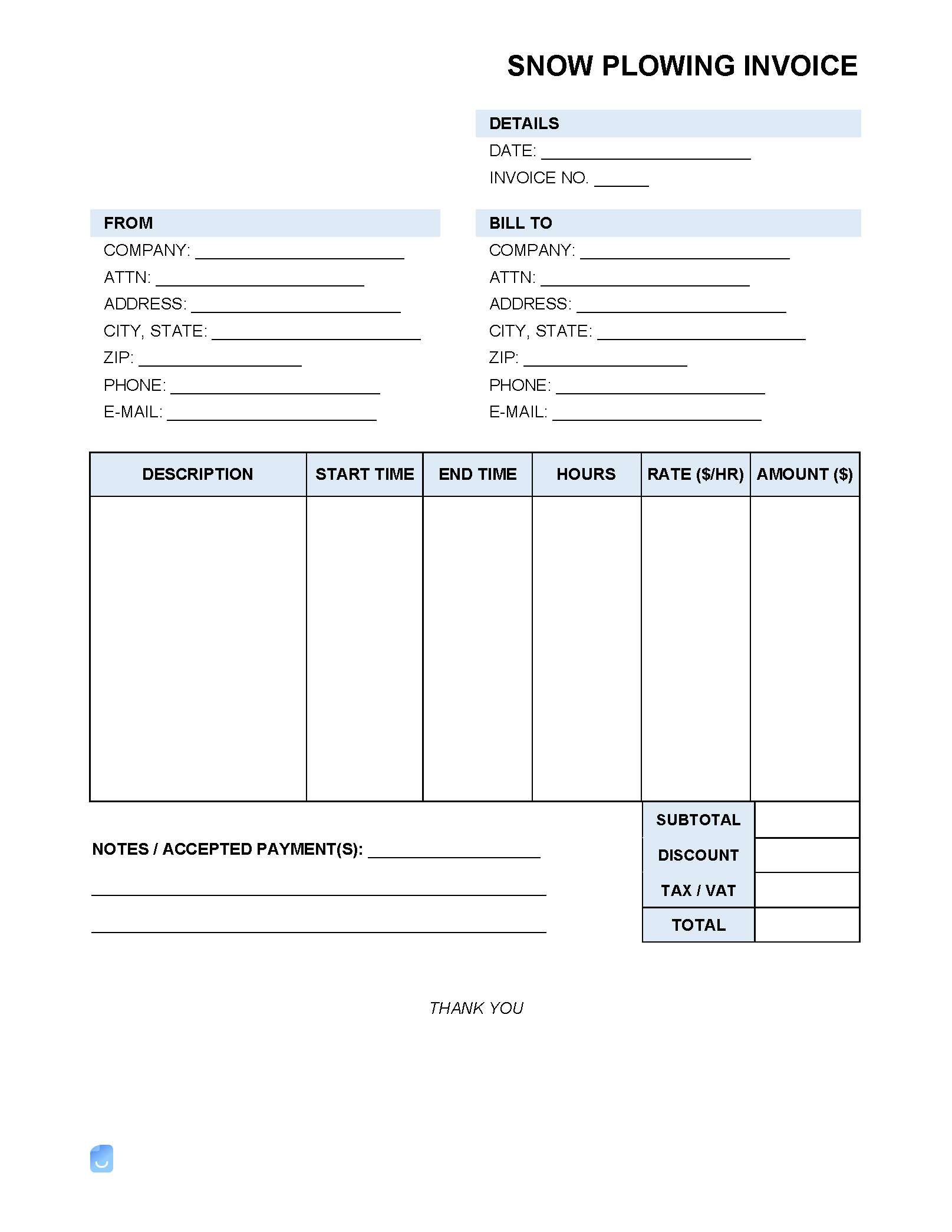

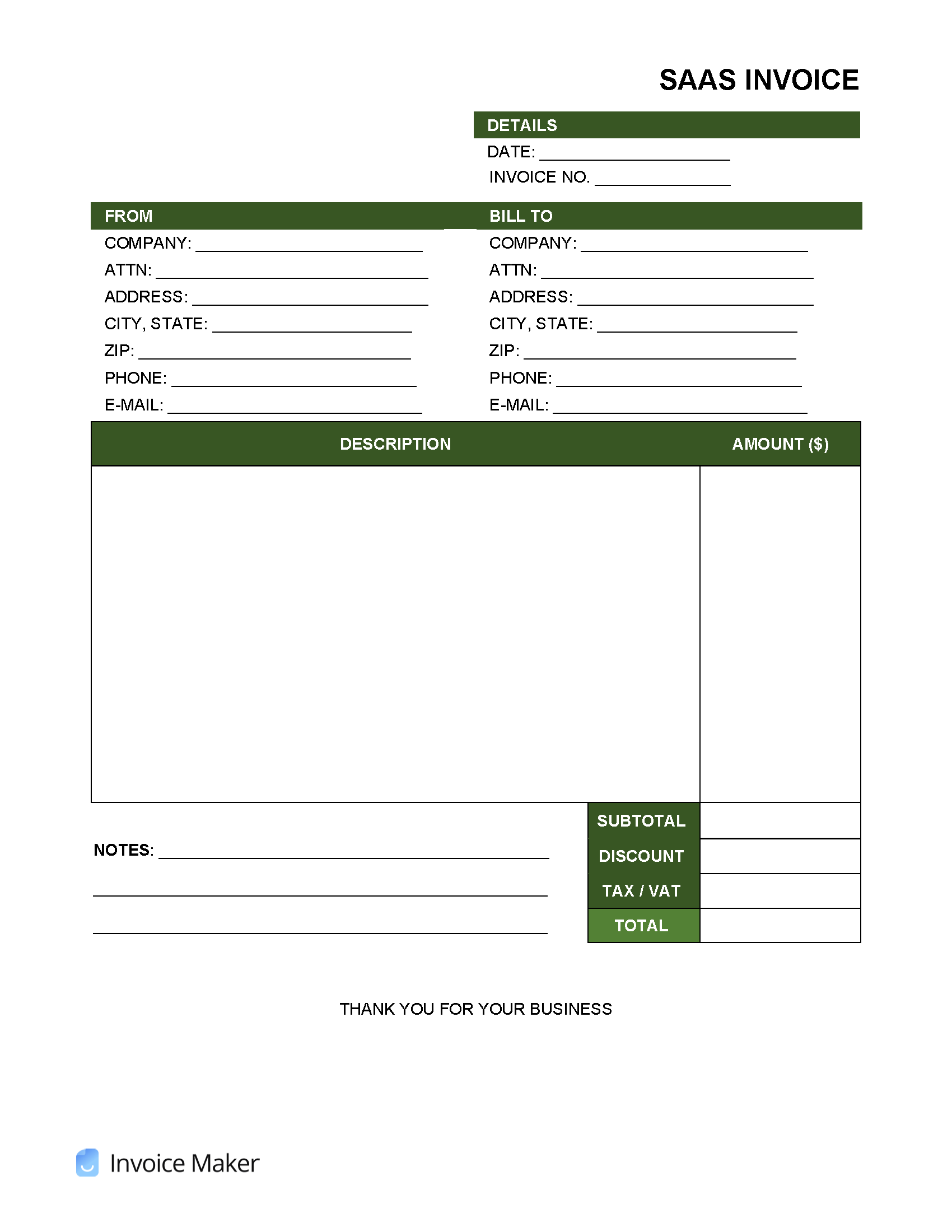

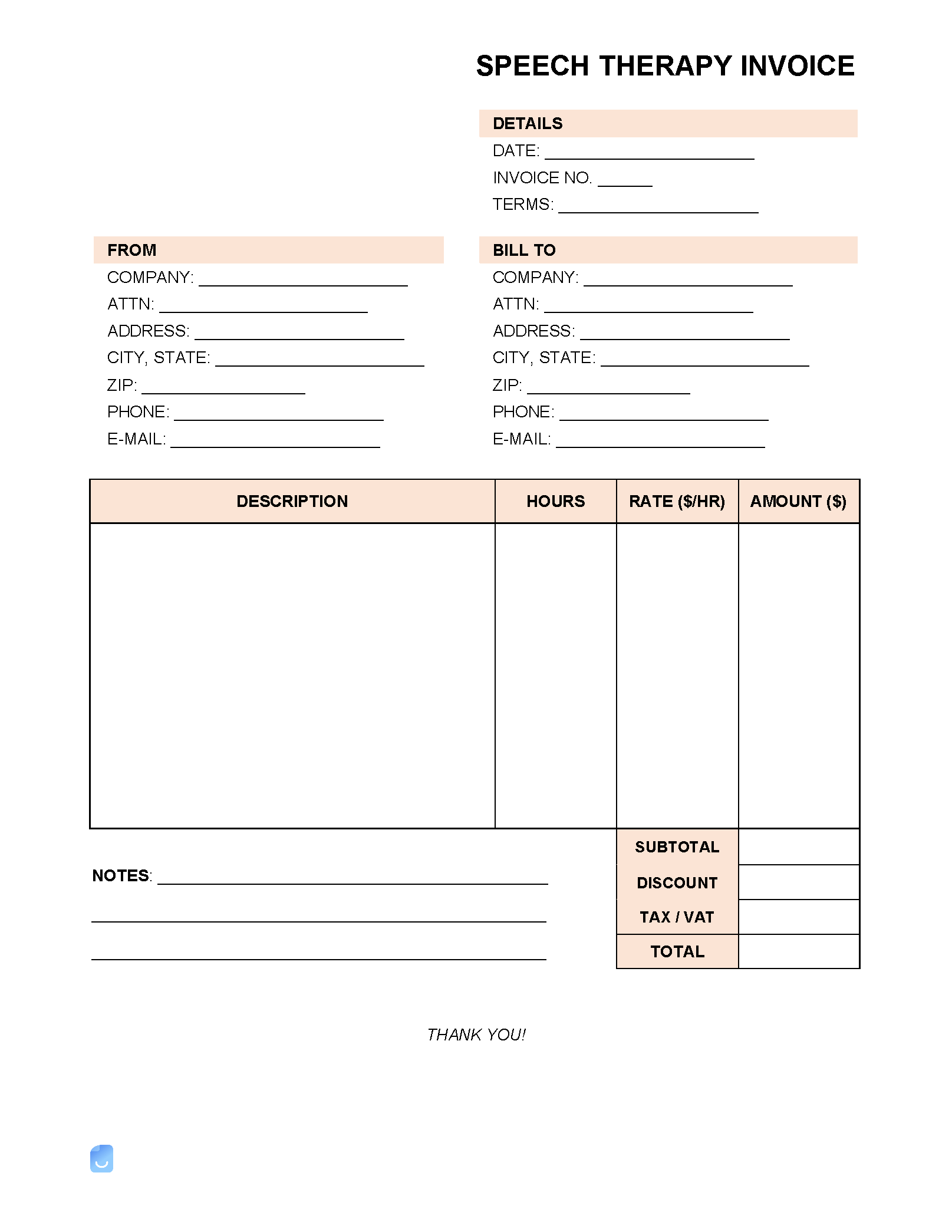

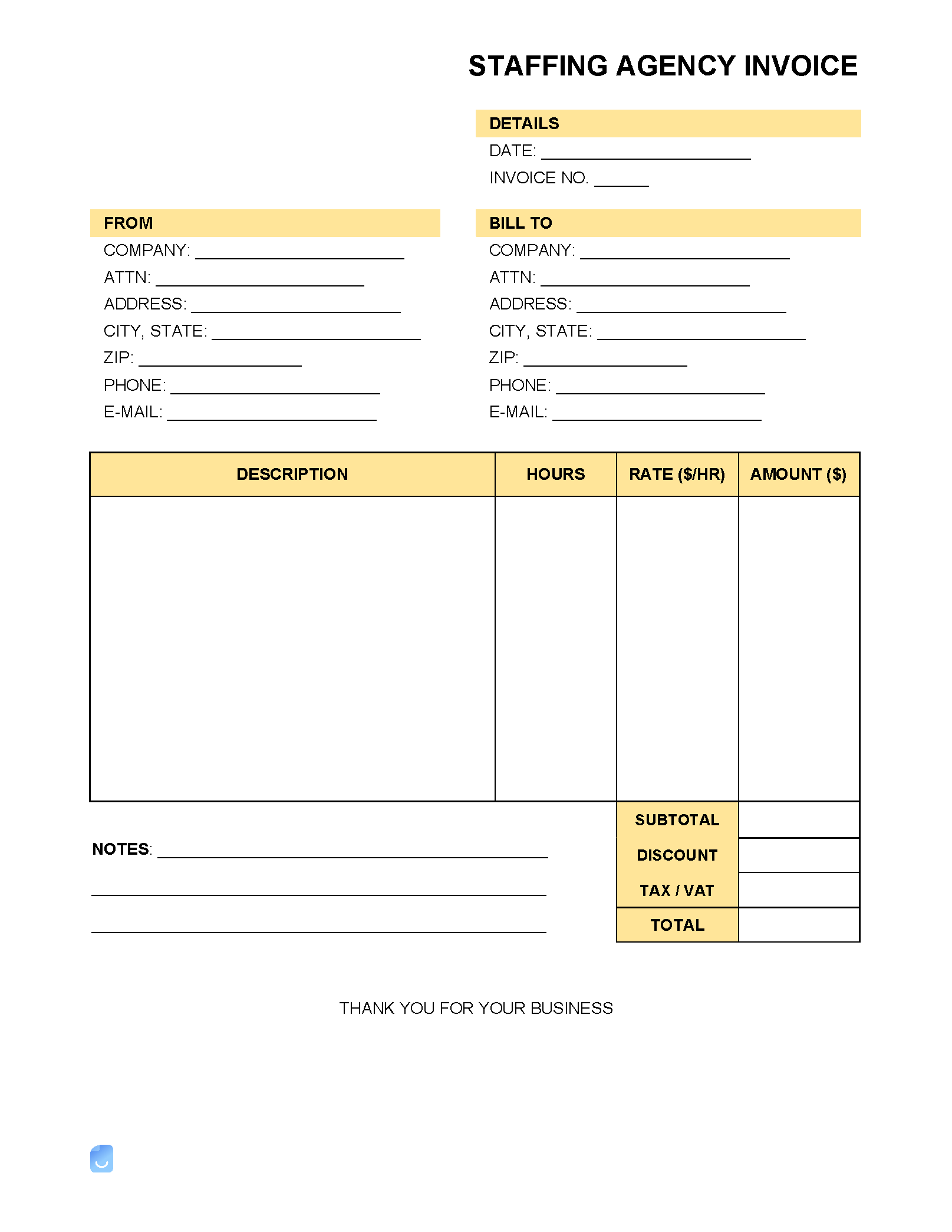

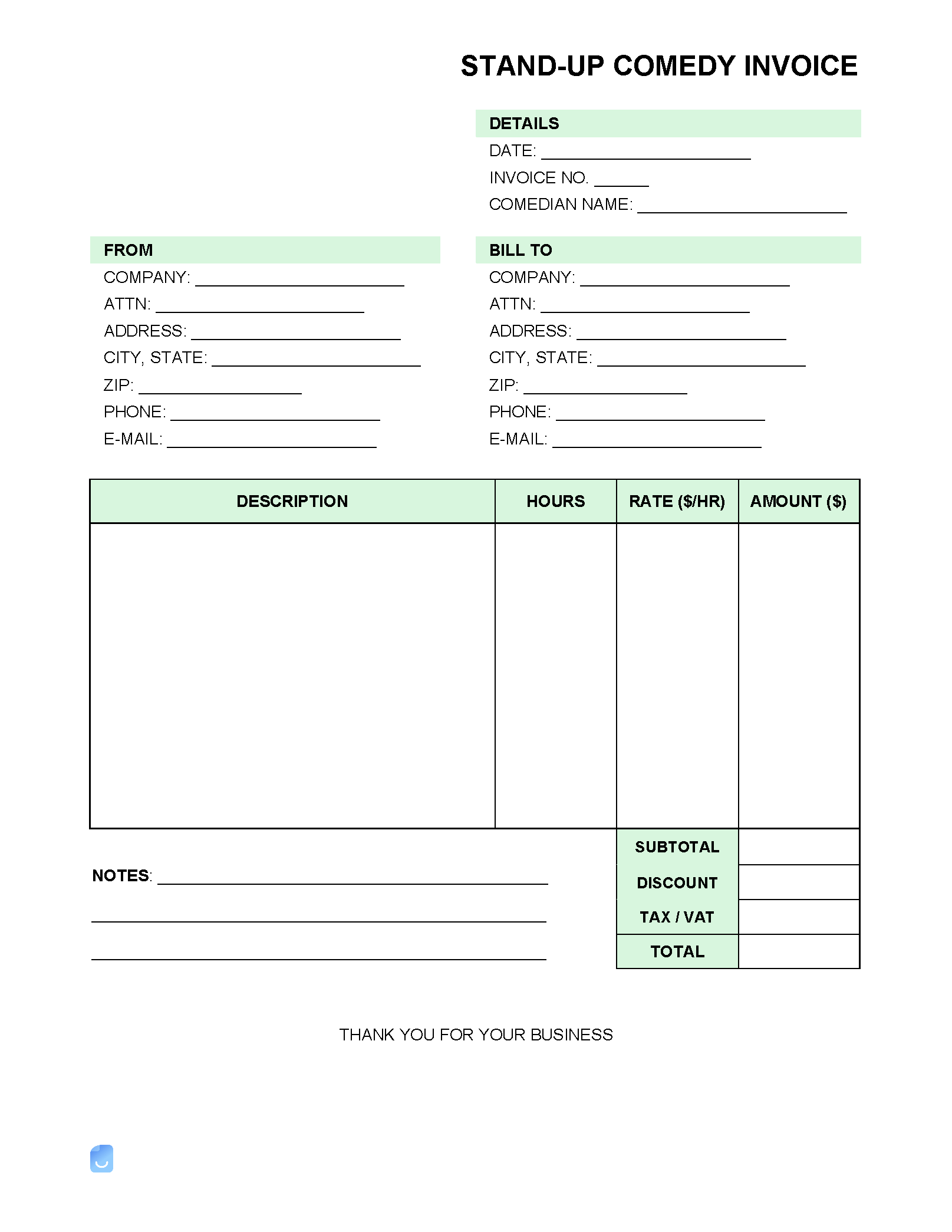

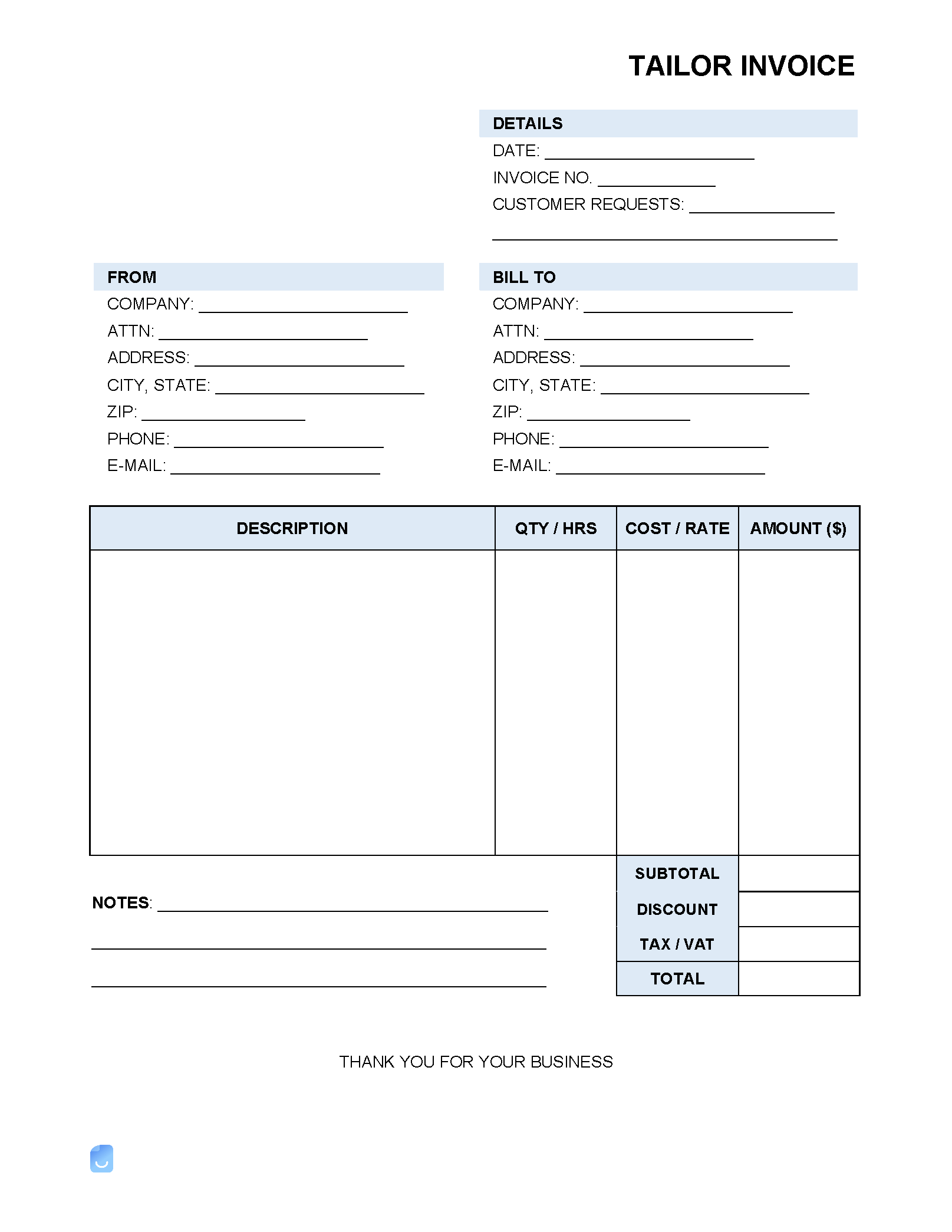

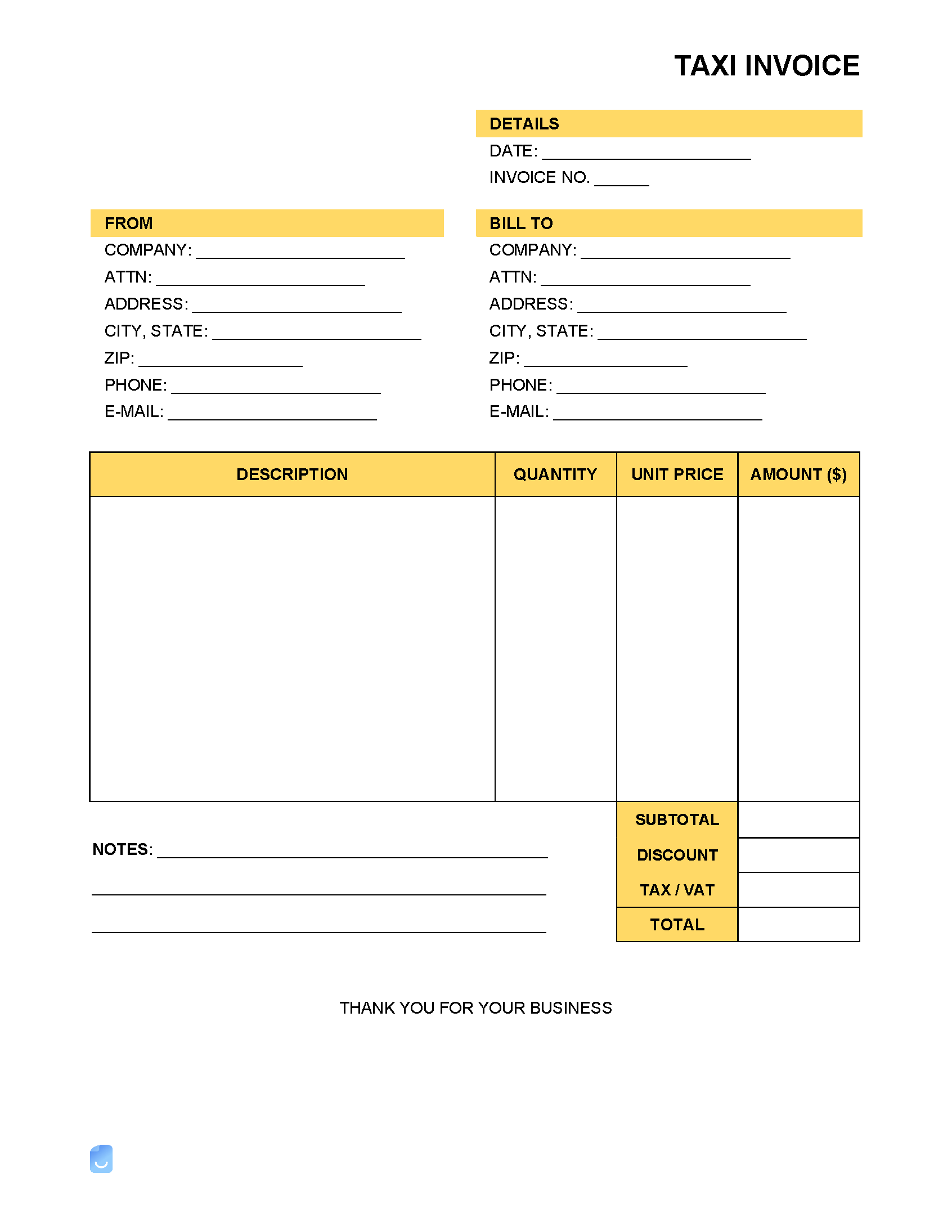

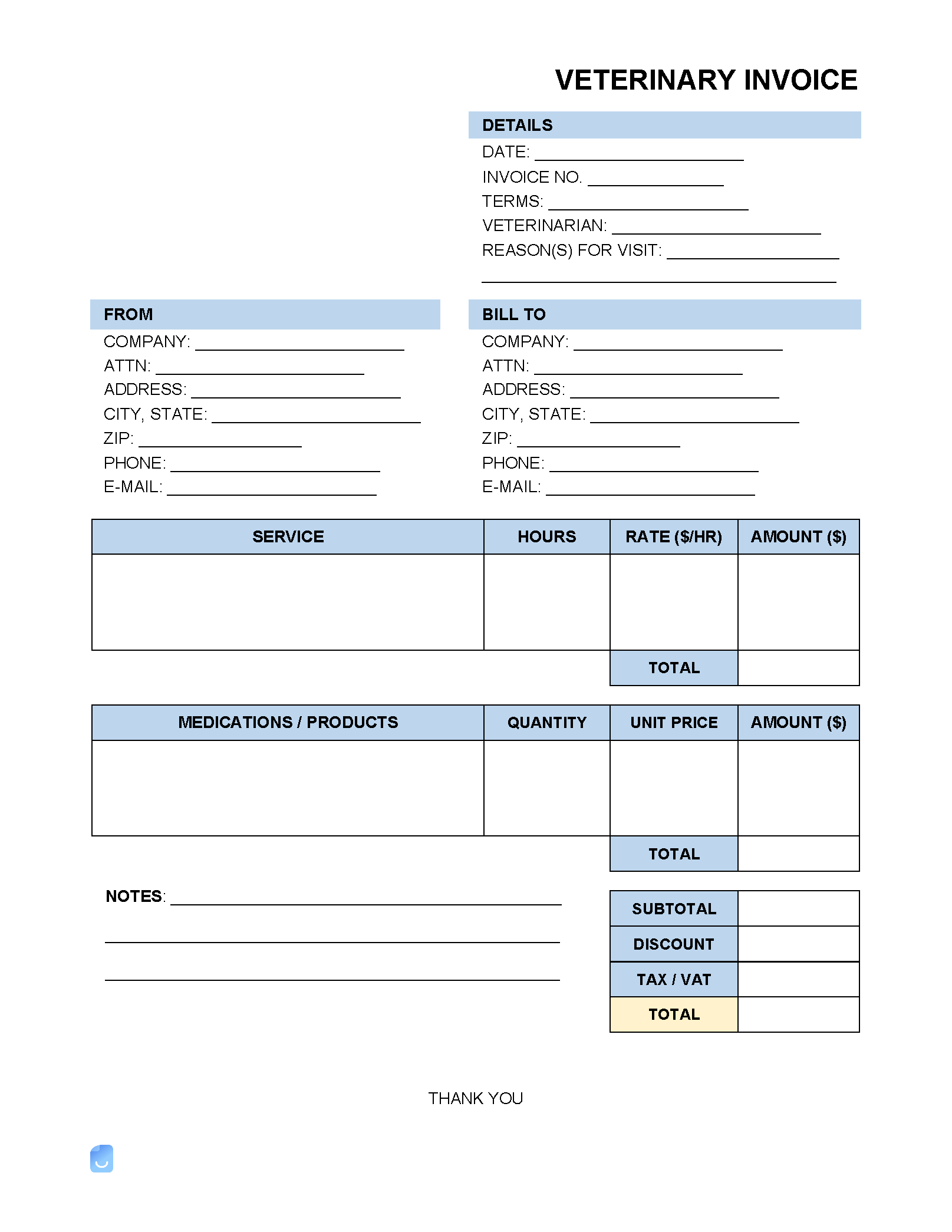

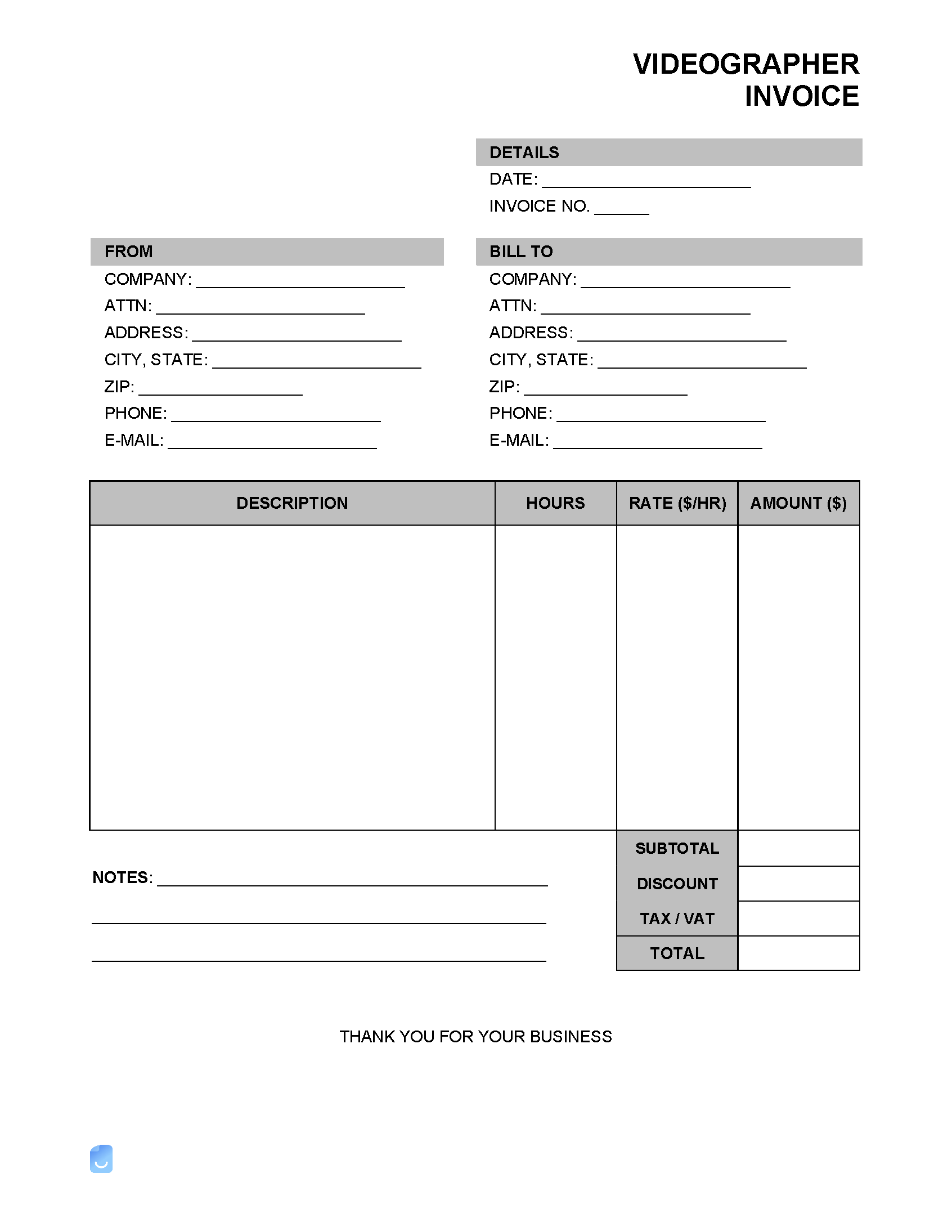

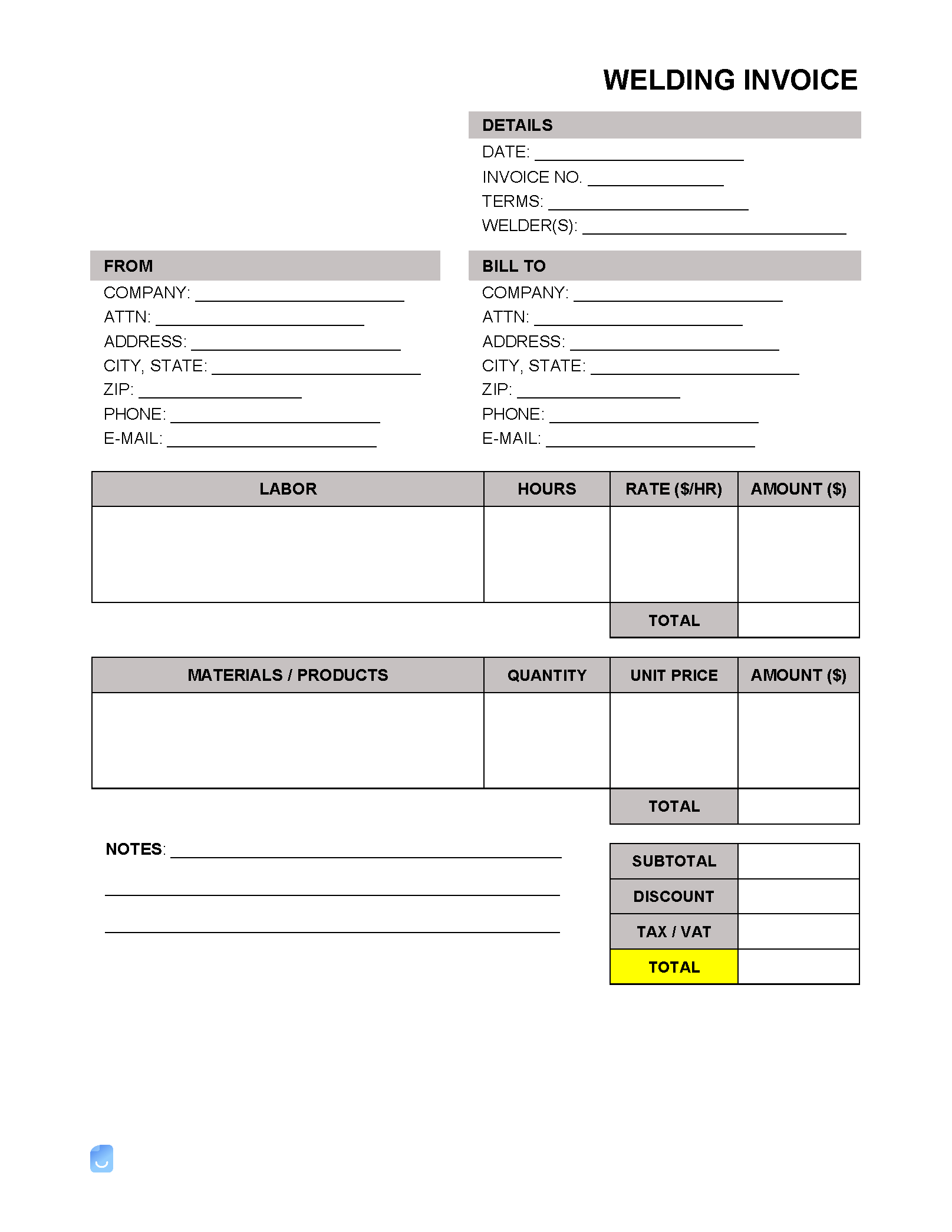

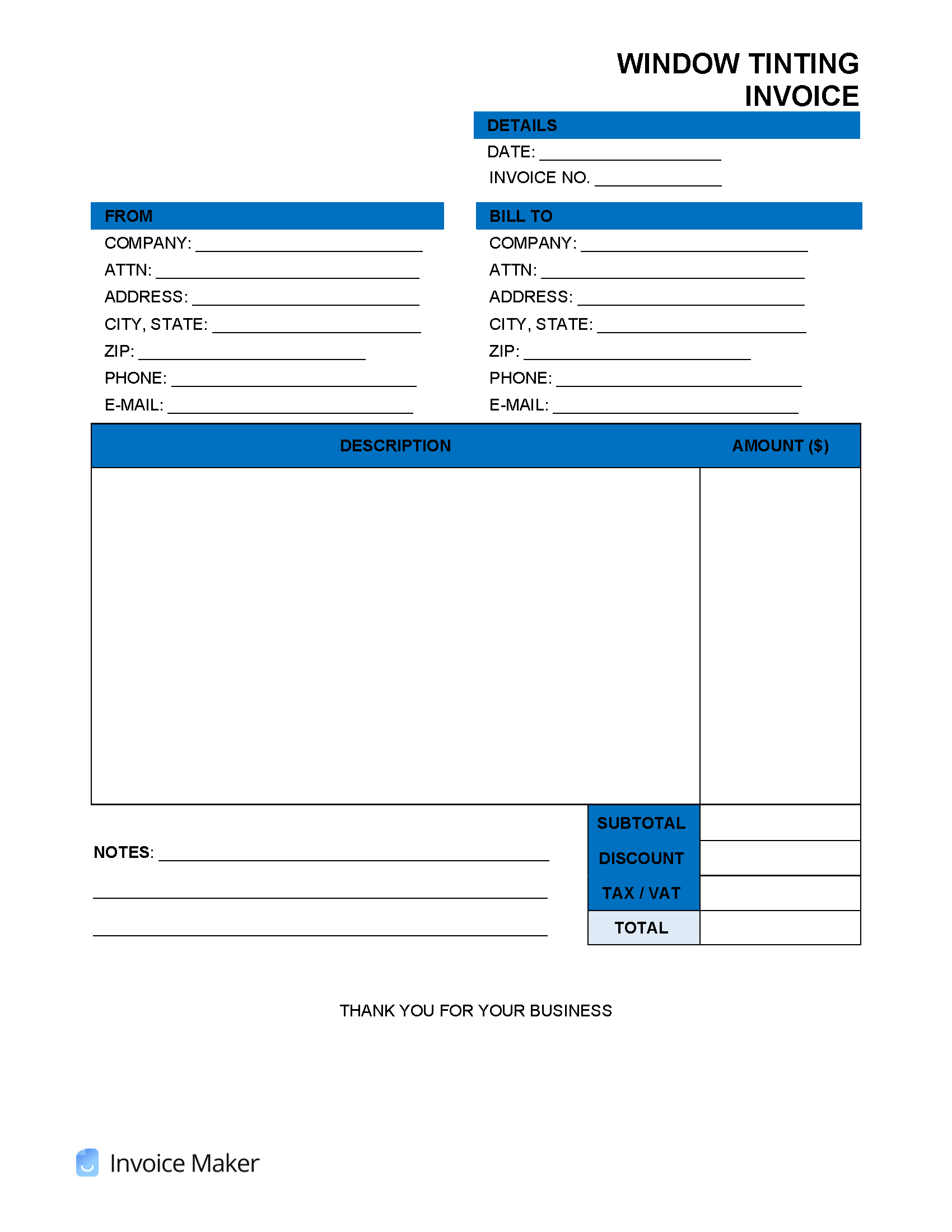

A service invoice, or an ‘invoice for services rendered’, is for any type of labor, consulting, or other work that is to be paid on a per hour ($/hour) or per job basis. The service invoice is mainly designed for an independent contractor, who would send the form to their client prior-to or after the service had been rendered. Once the invoice has been paid, the client should be sent a receipt marking that a partial payment or the full balance has been paid.

The average rating is 4.5/5, for null votes.

A service invoice is a document delivered to a client from a contractor or business after providing labor in the form of consulting, advising, or providing actual labor. The invoice is to be served on the client as a demand for payment. The date when the total balance is due is commonly 15, 30, or 60 days for most businesses. If the client goes beyond the due date, late charges and/or interest may be applied per the service agreement. After payment is made, the invoice should be marked as paid and act as a receipt.

Due to IRS Requirements, an invoice must be kept on record for three (3) years from the tax year date or two (2) years from which the tax was paid, whichever is longer.

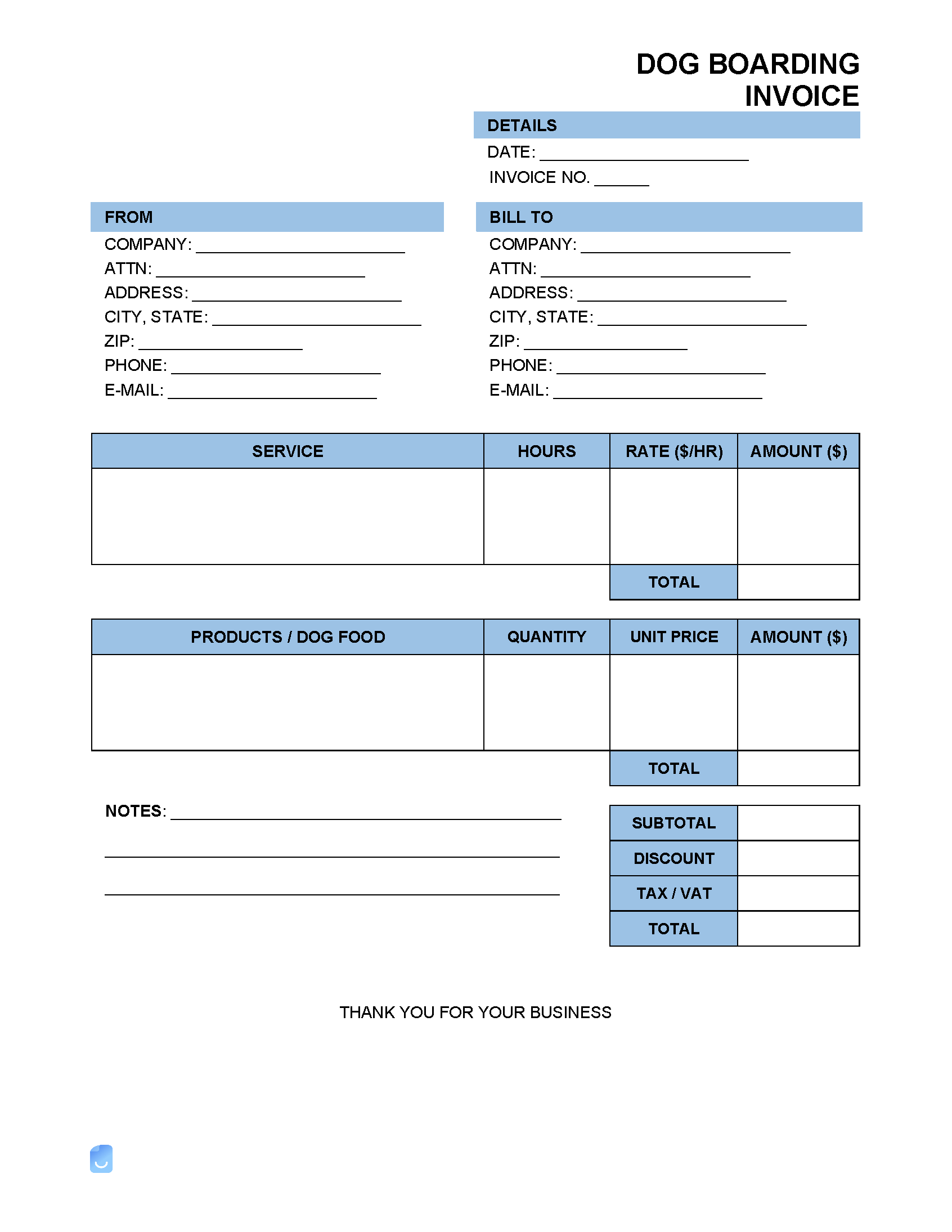

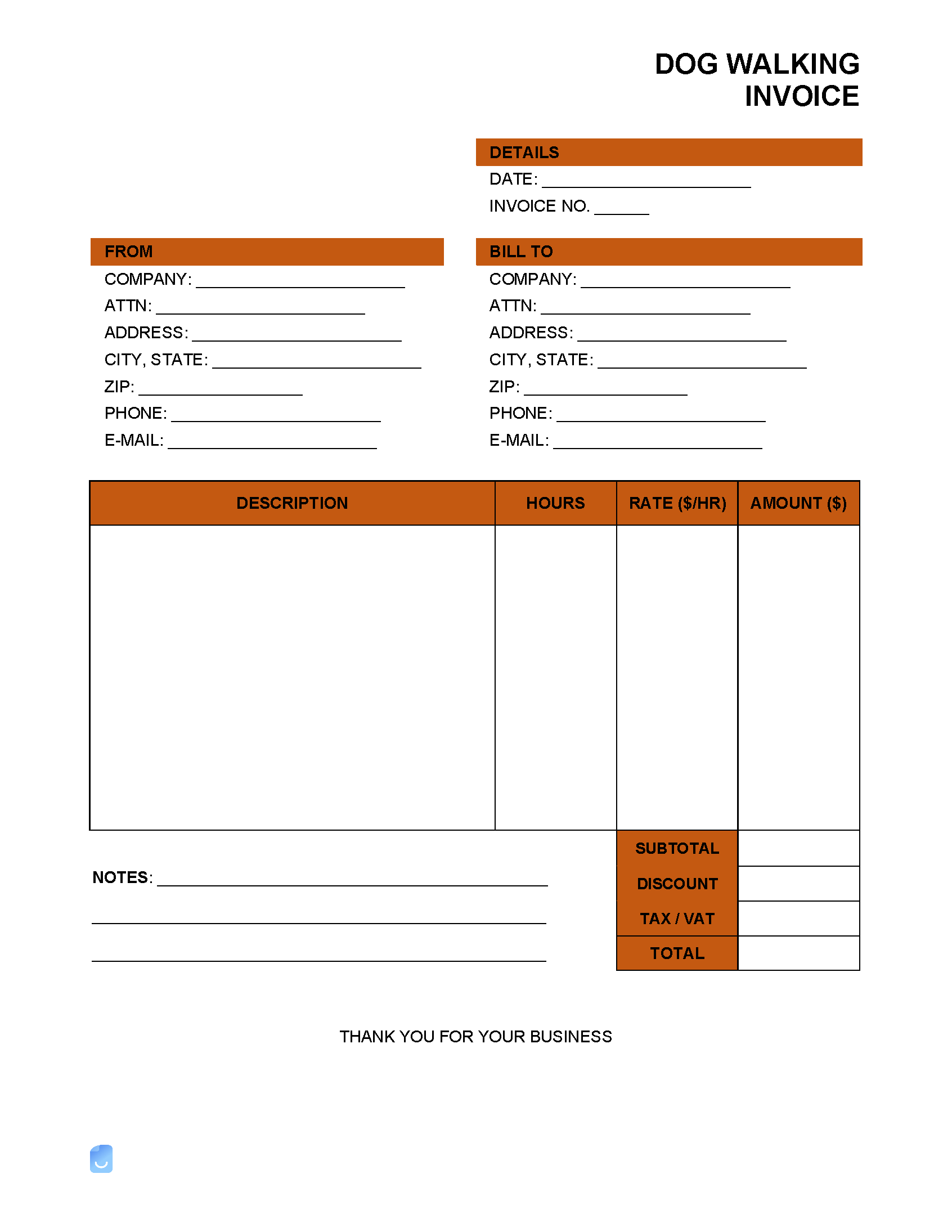

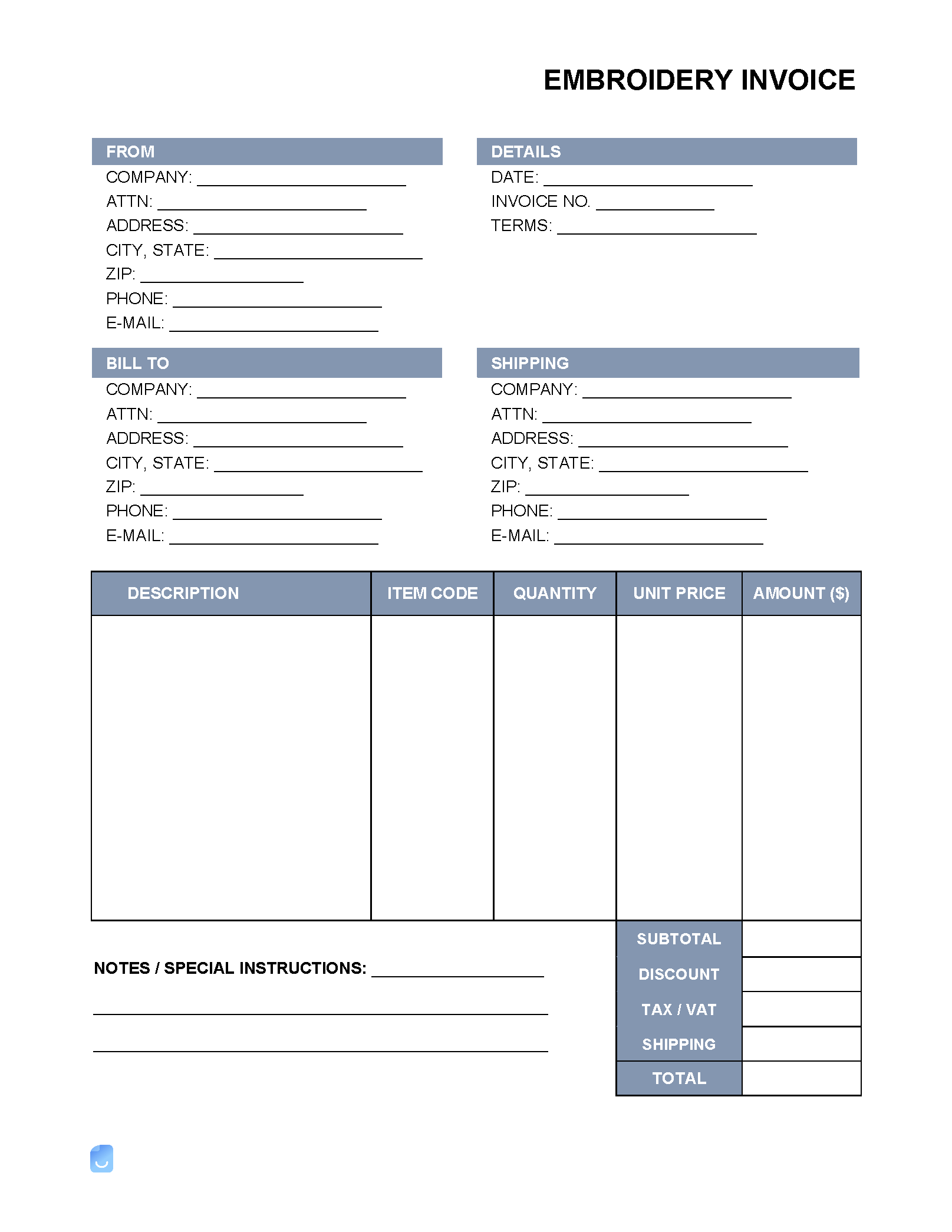

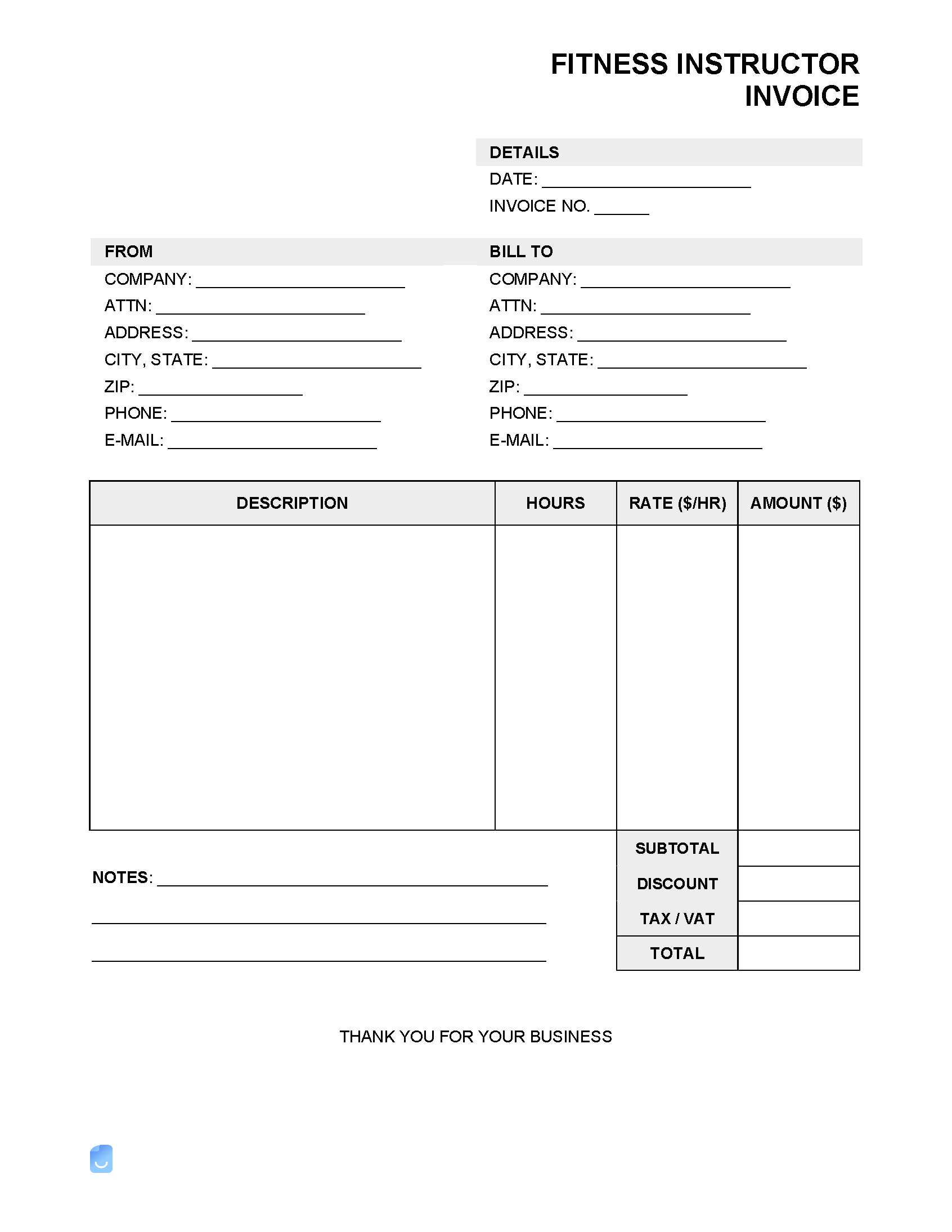

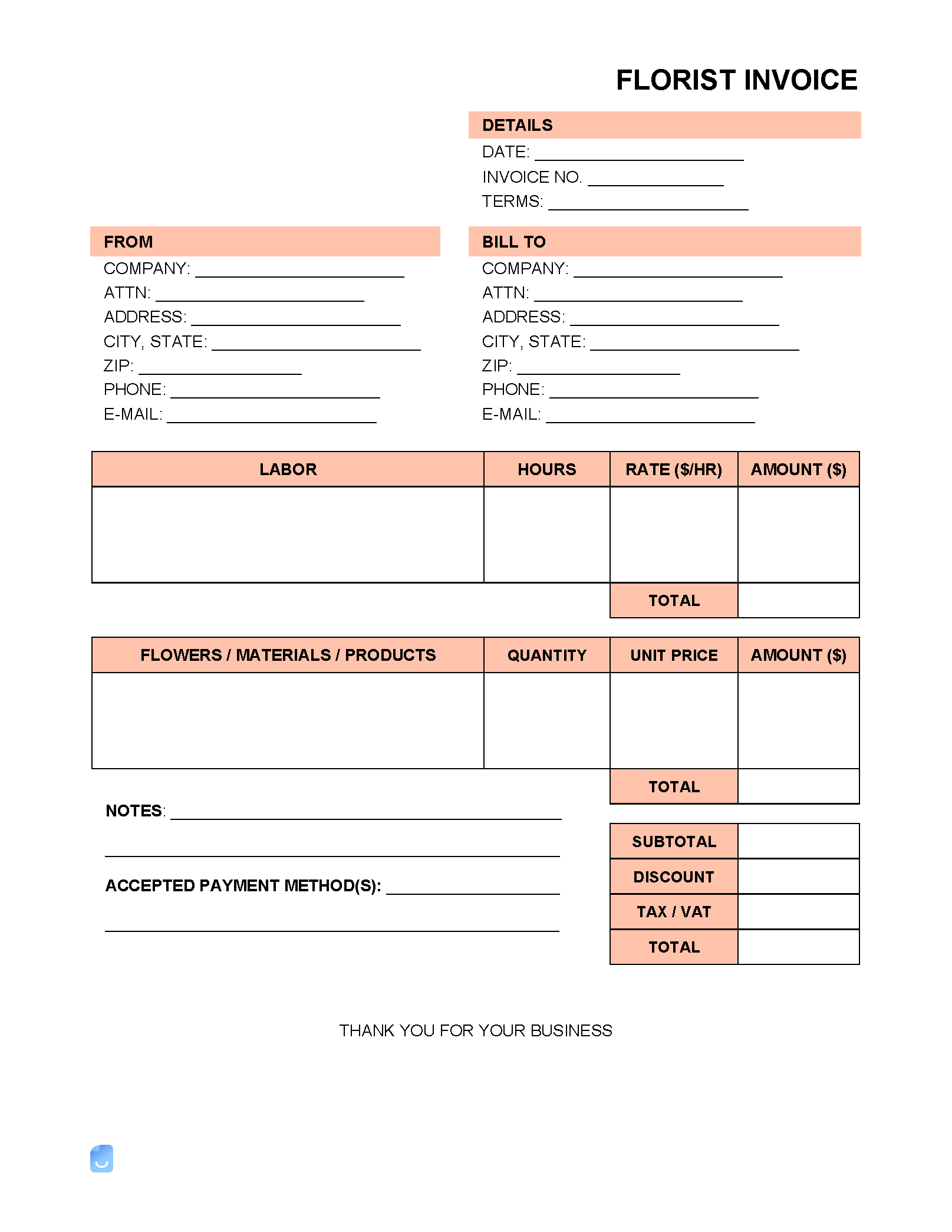

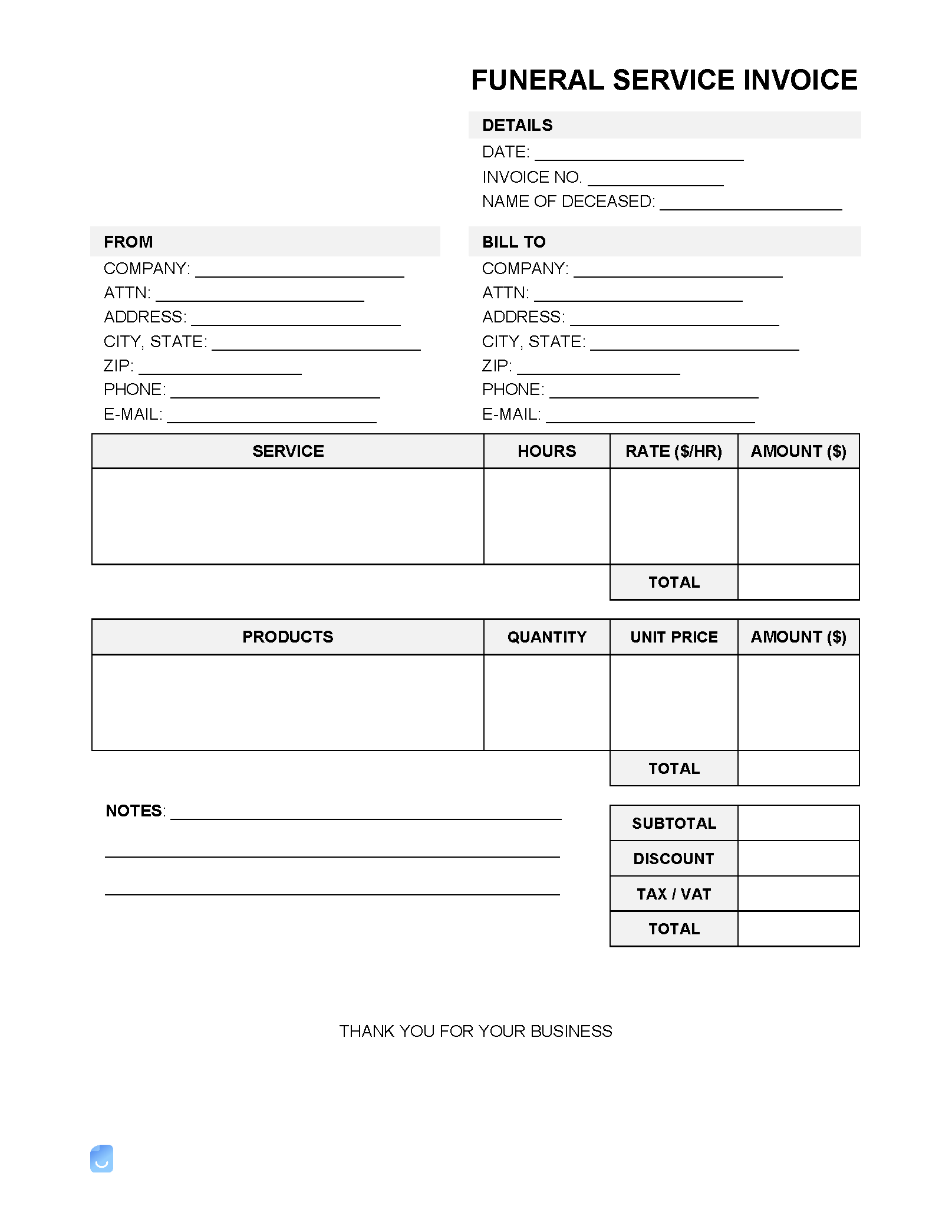

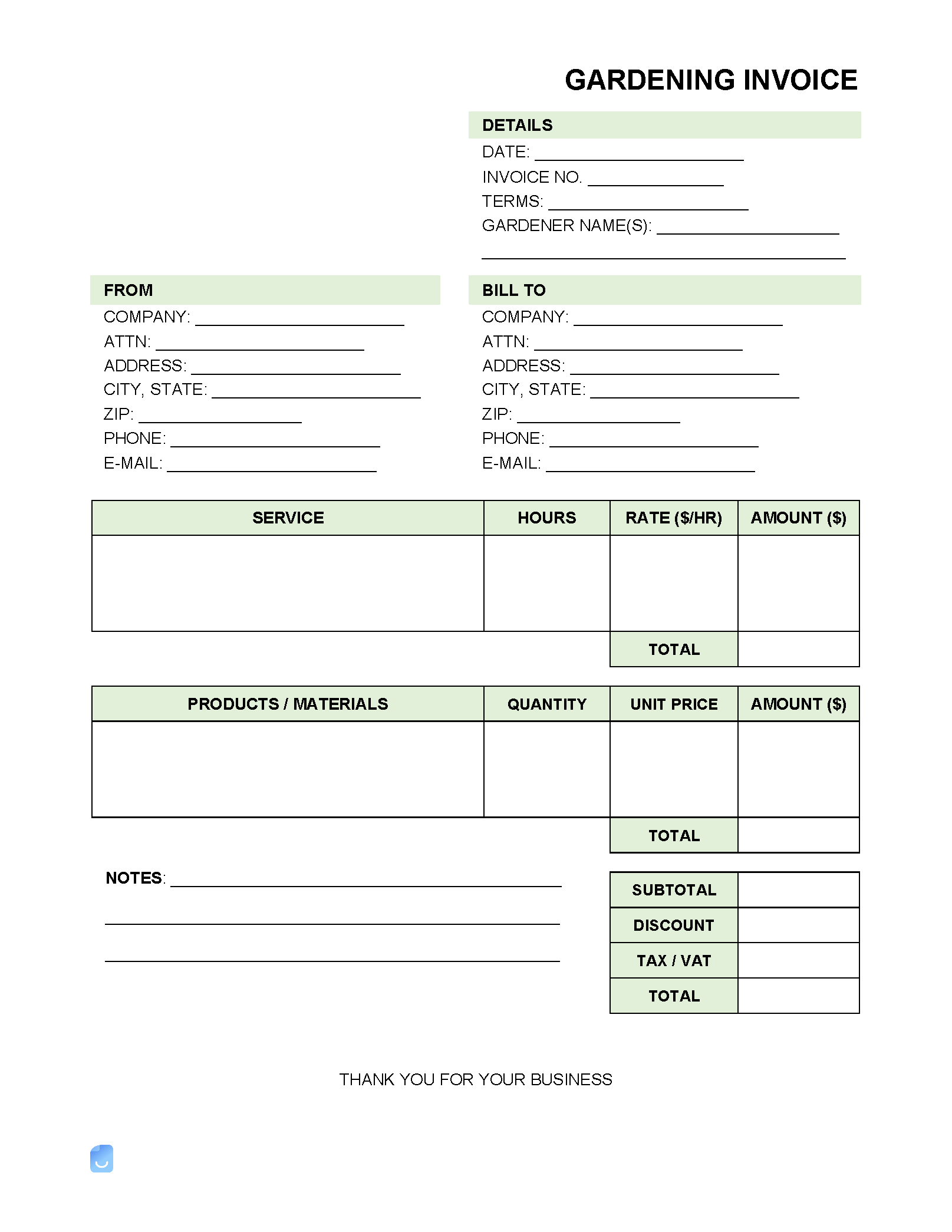

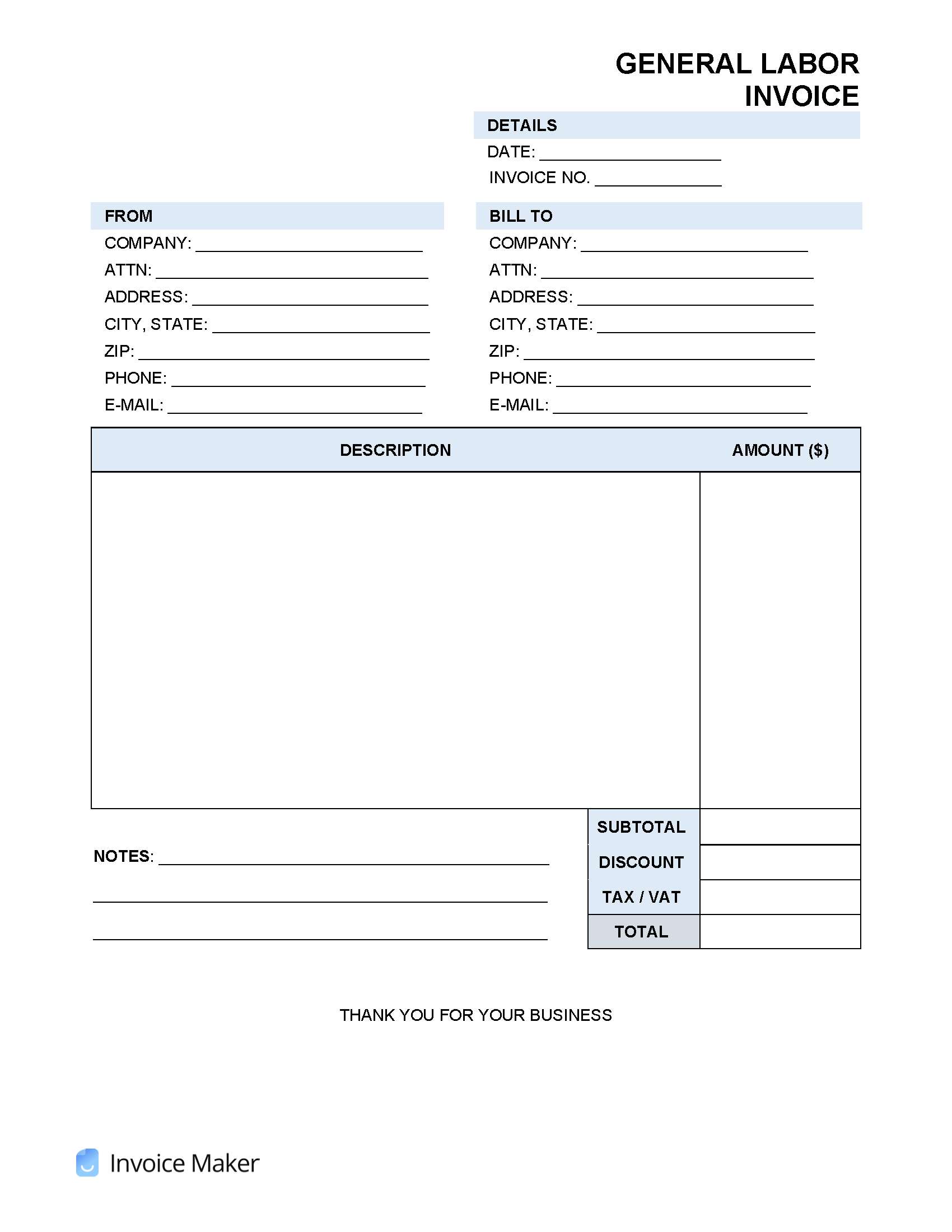

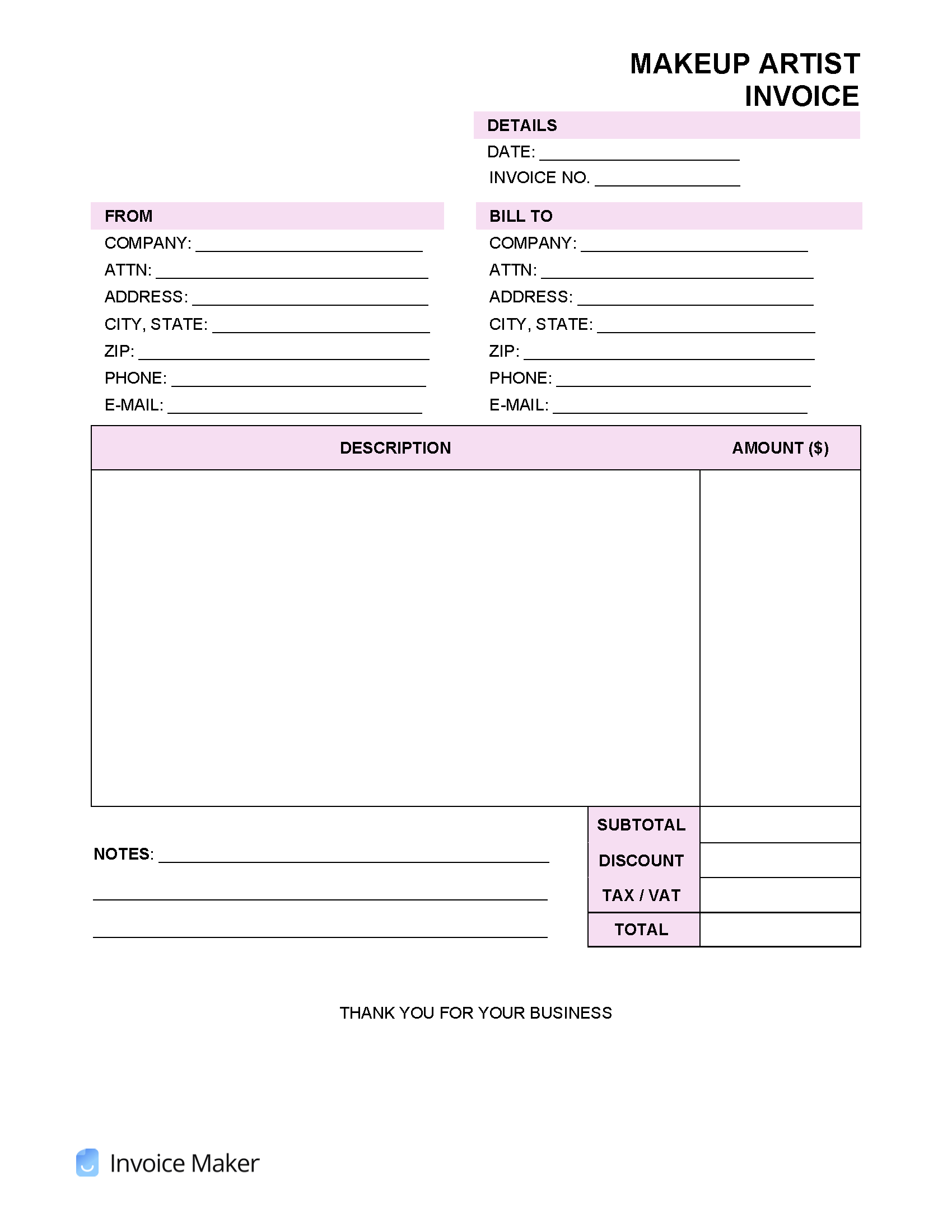

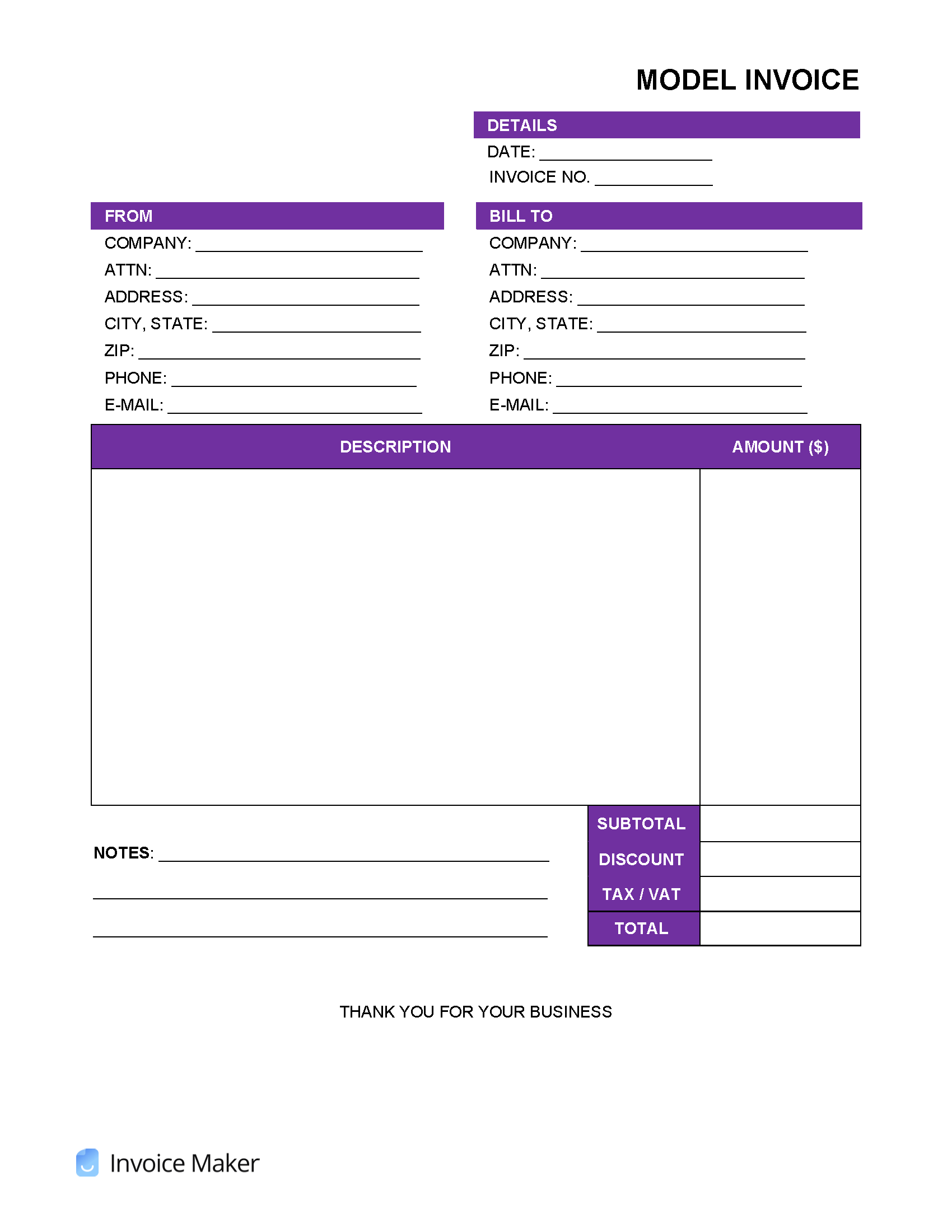

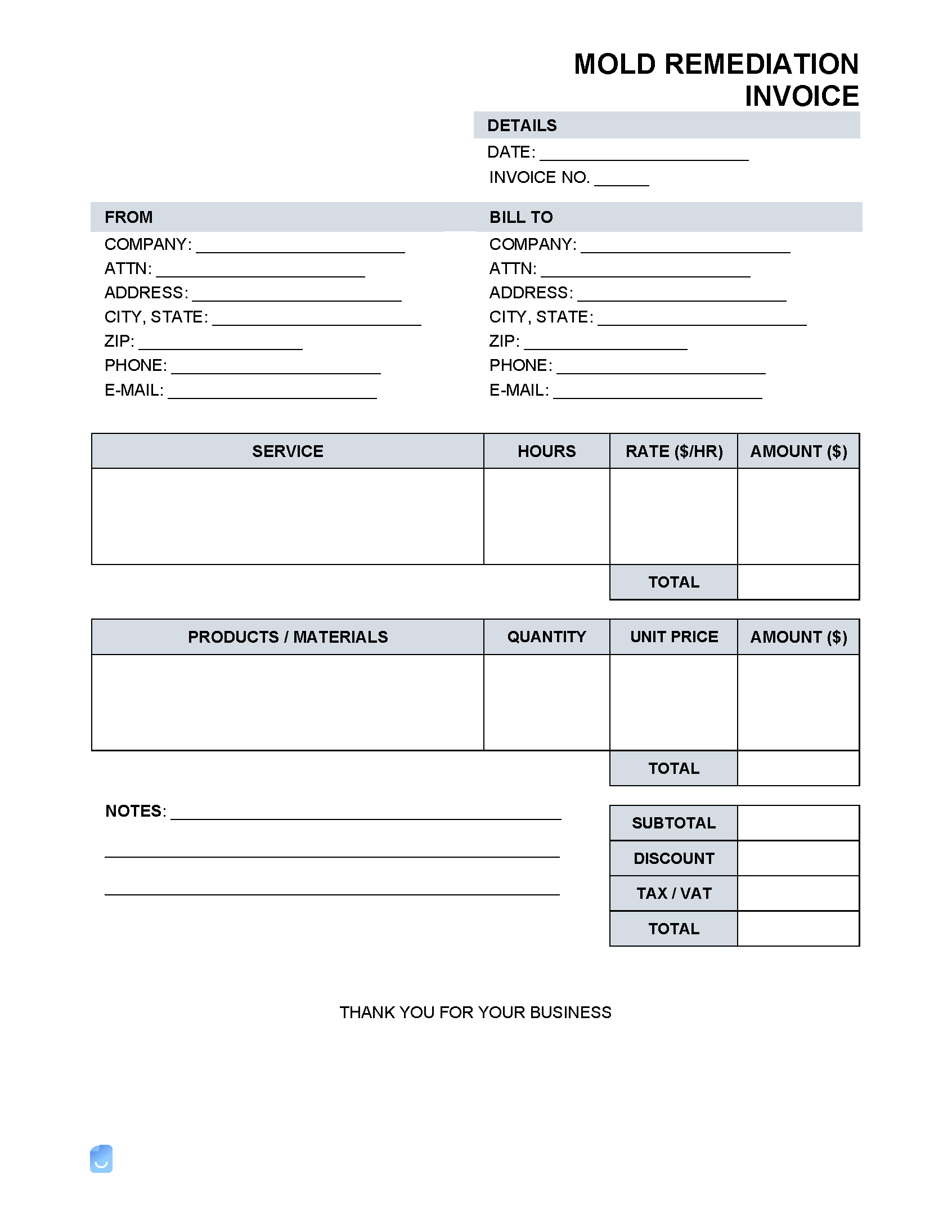

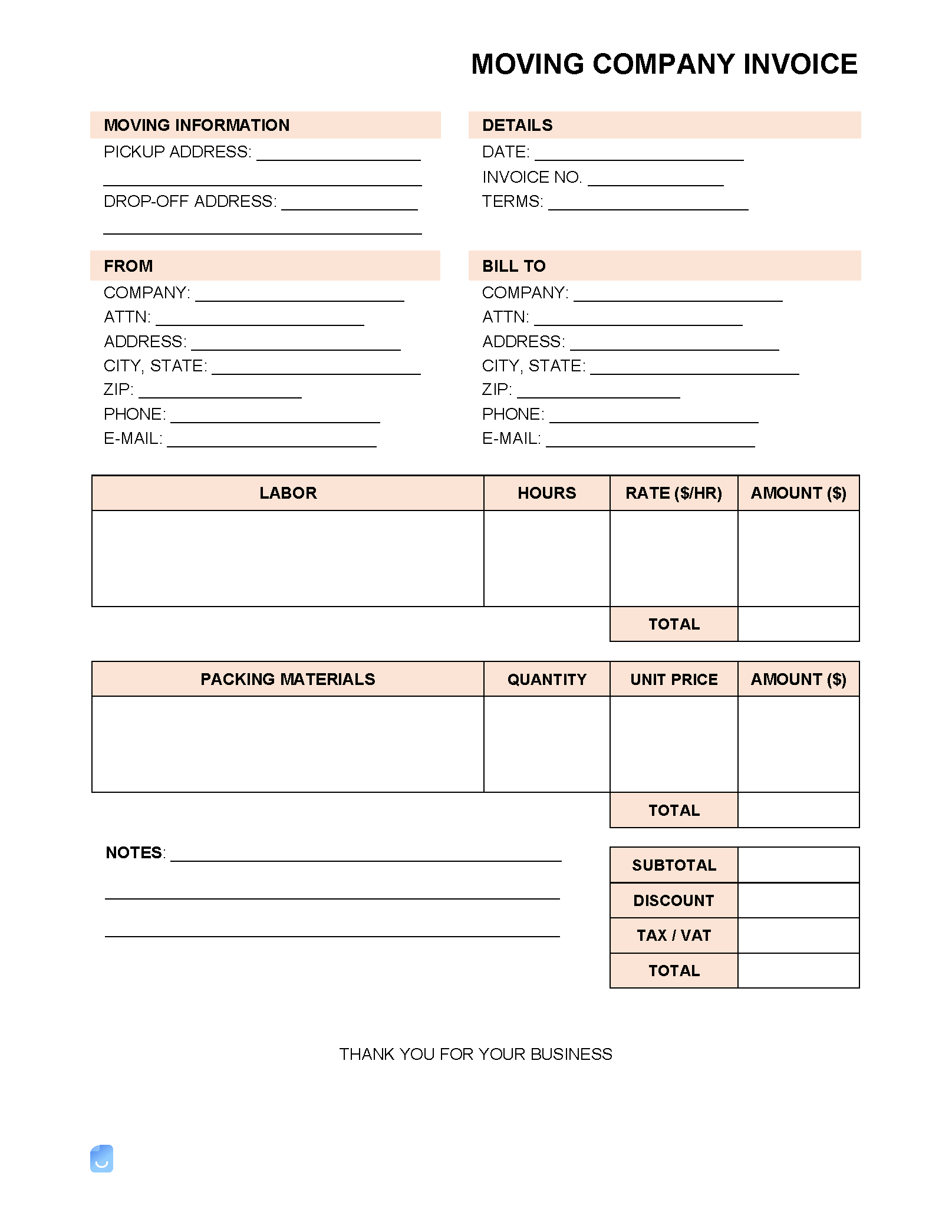

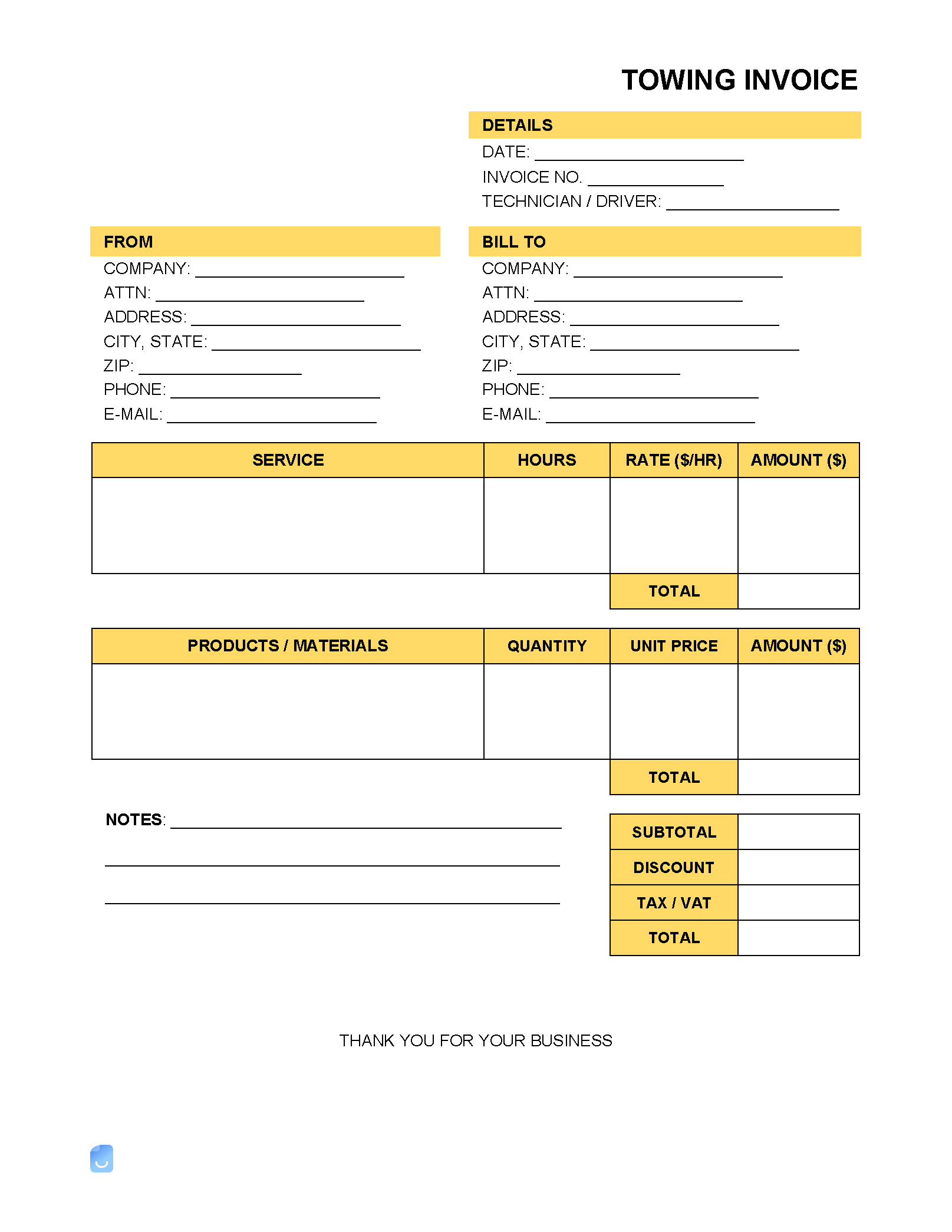

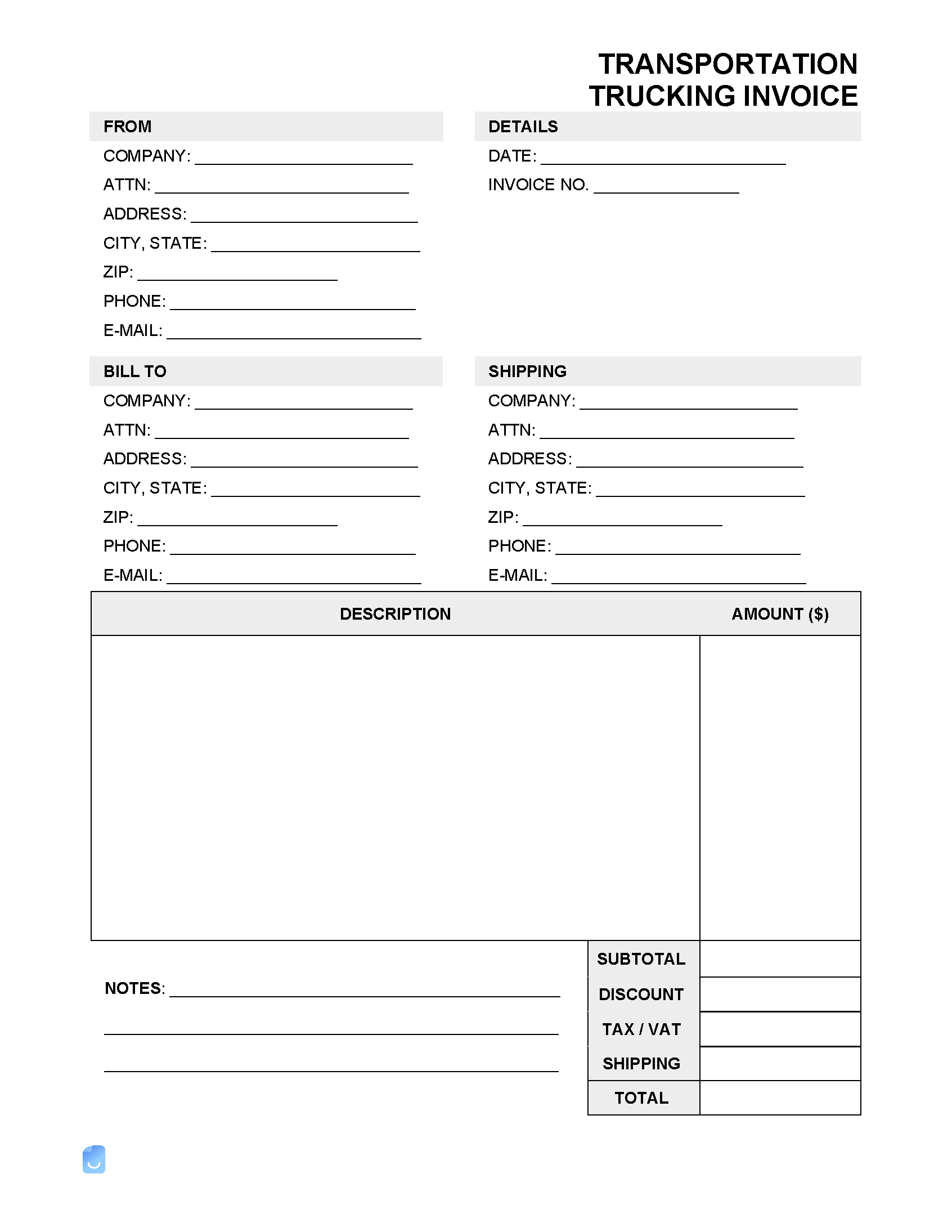

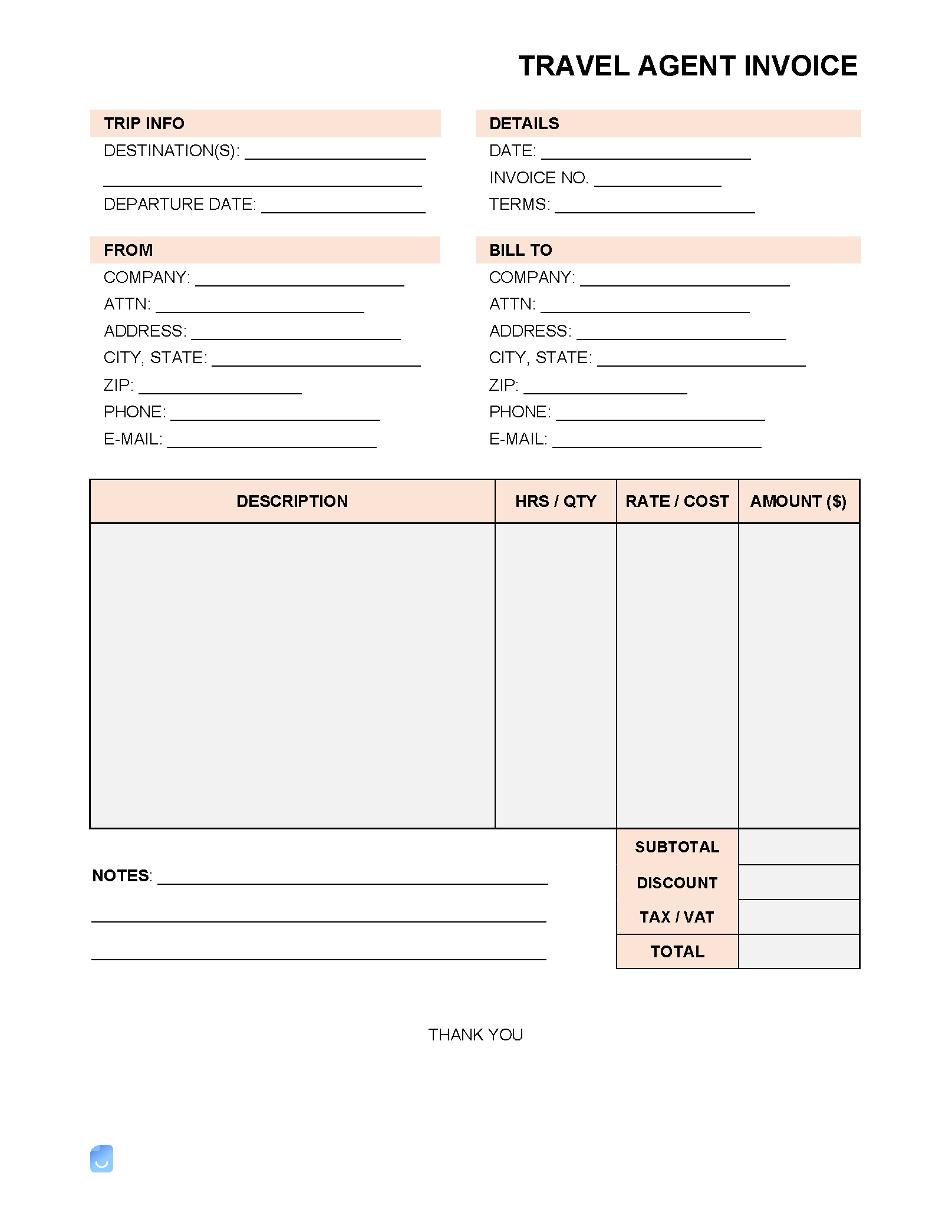

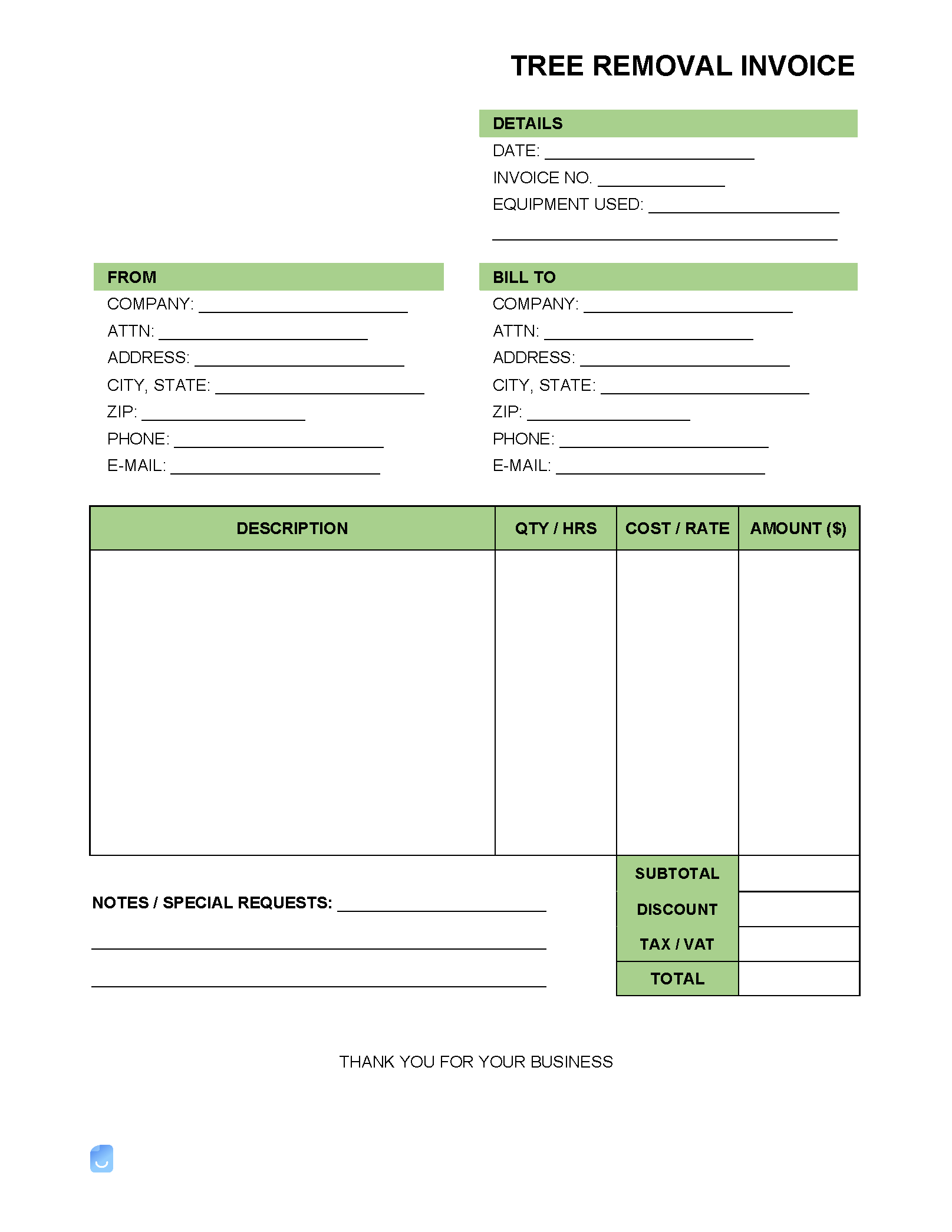

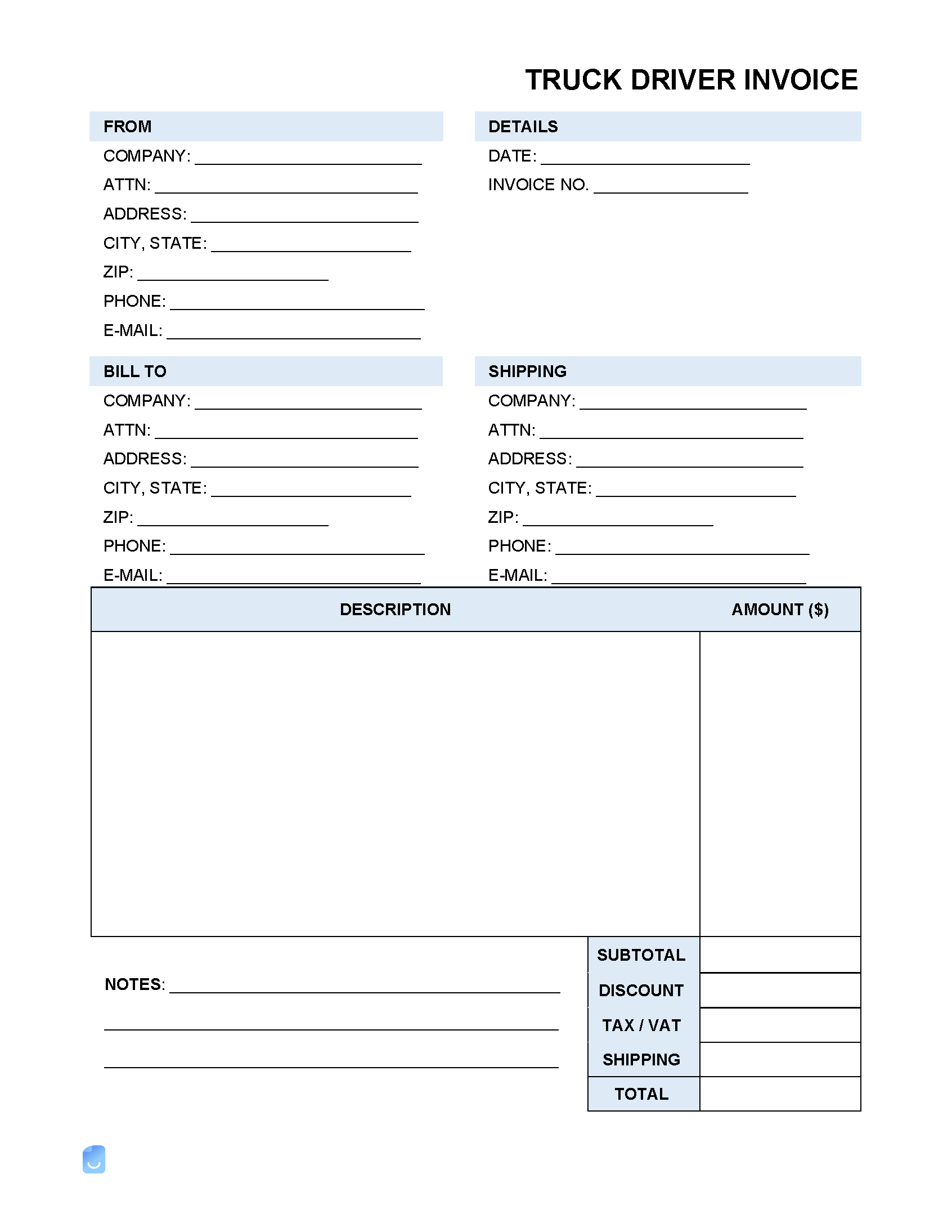

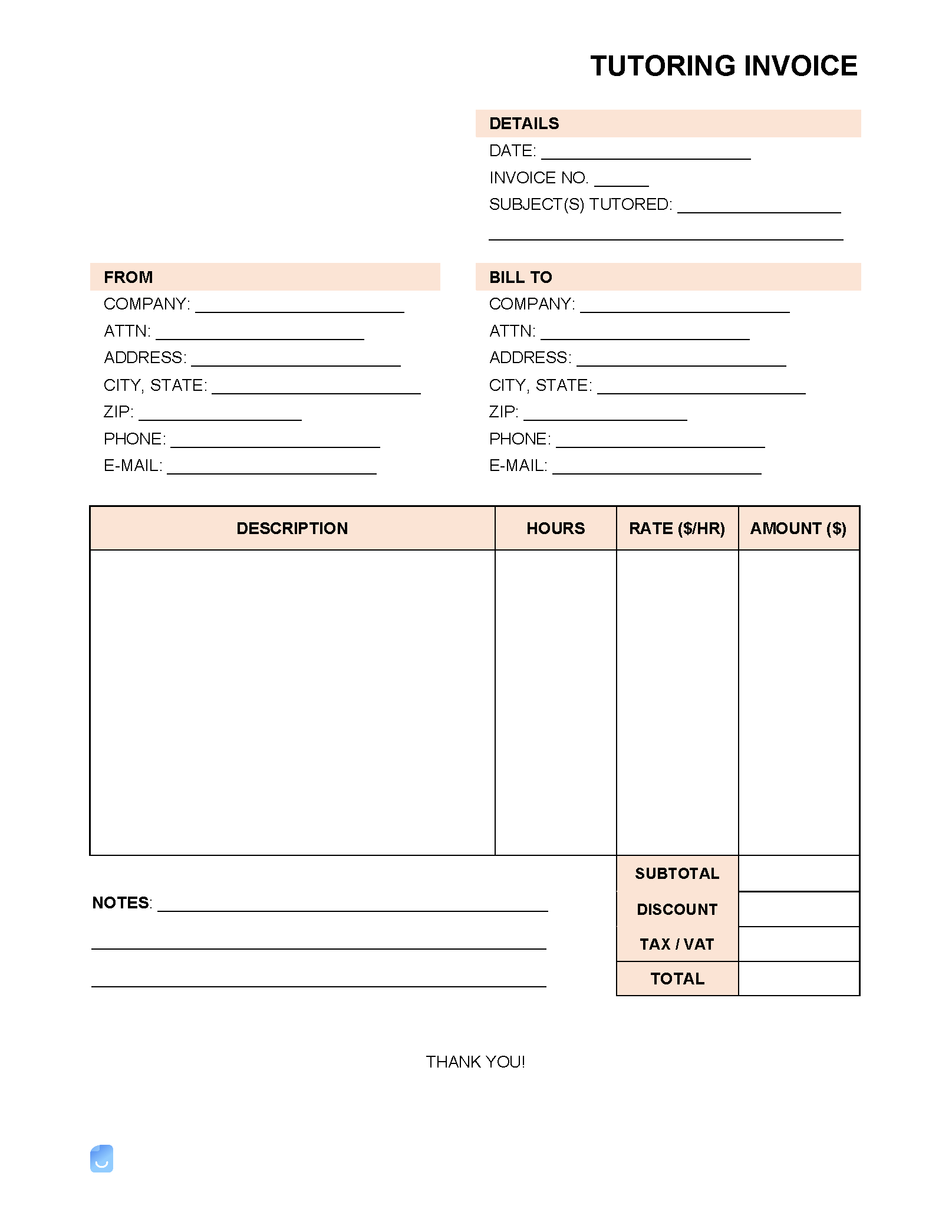

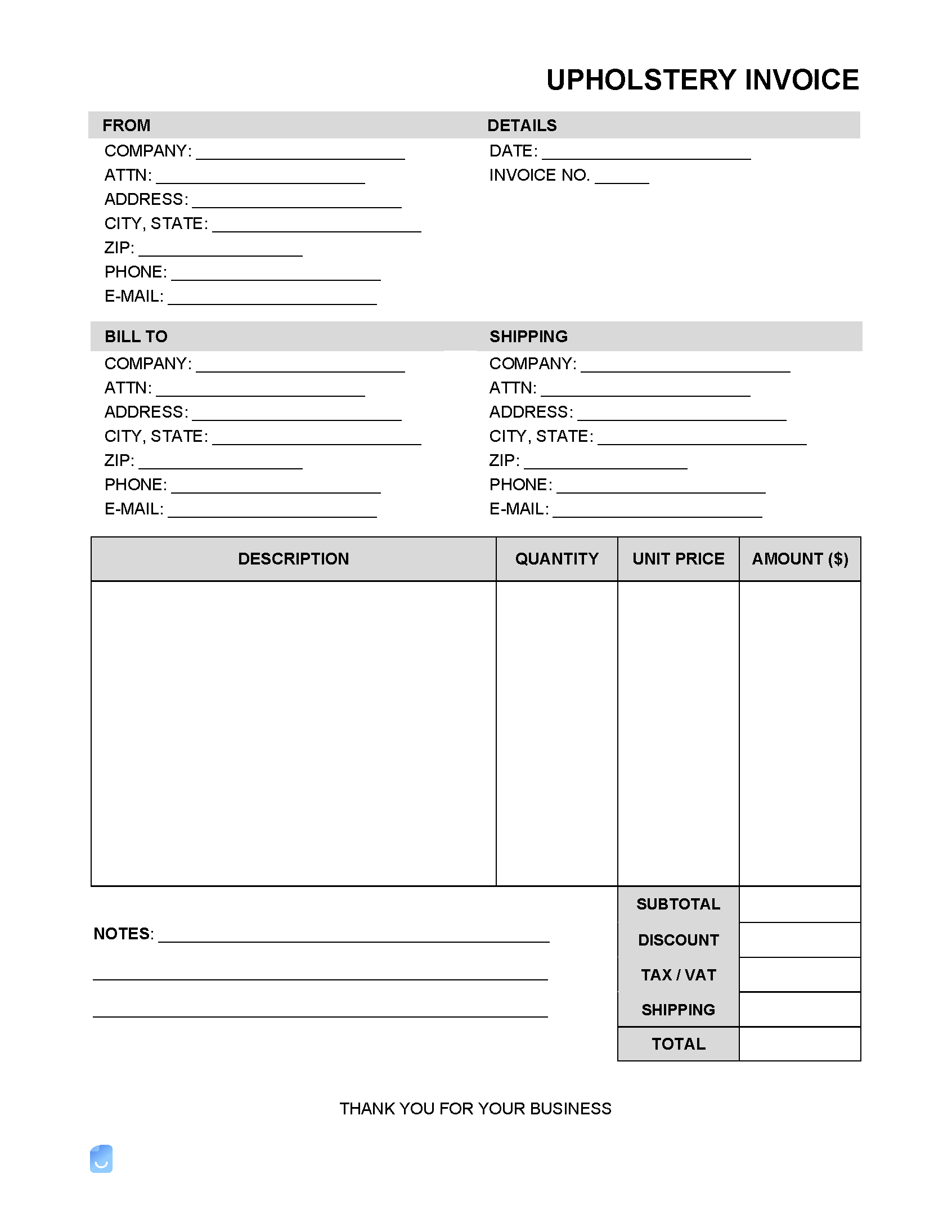

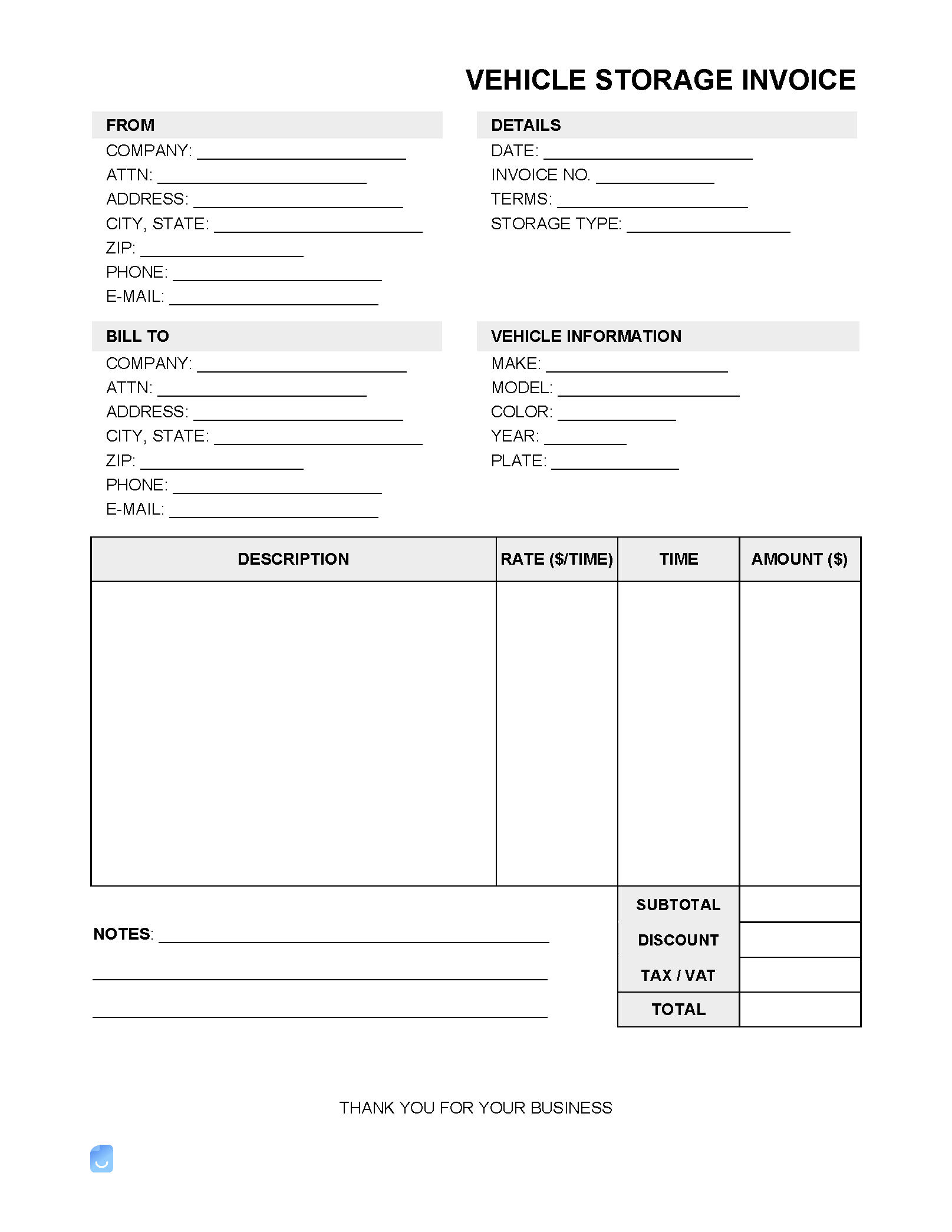

A service invoice can be used for any type of labor that is paid on an hourly basis or on a per-job basis. The most common types of services, where the laborer is acting as an independent contractor, are as follows:

There are three (3) ways to pay an independent contractor, per project, per gig, and per hour ($/hr).

When a contractor is paid on a per-project basis, payment is made at the completion of the work. This is often due to other factors such as equipment, employees, and other costs.

In other situations, the independent contractor is paid on a per-task basis. This is common for jobs when it’s difficult to track the laborer’s efforts and base the pay on performance.

Being paid on a per hour basis due to their efforts. This is especially common when the employer is providing the equipment, space, and tools necessary for the individual to complete the job.

The main difference between an employee and an independent contractor is that an employee gets certain guarantees, such as unemployment, medical insurance (in some cases), and time-off, whereas an independent contractor is “their own boss” and must withhold their own taxes from income. An employee:

An independent contractor:

We use cookies to improve your experience on our site and to analyse web traffic. To find out more, read our updated privacy policy and terms of use.